How to calculate tax on Swyftx

Cypto tax calculators makes the process of calculating your swyftx tax a lot easier. There are 2 major methods you can use to properly use a tax calculator with your swyftx data. One of them is through the use of CSV file, and the other is API integration.

How to get your CSV data on Swyftx

Follow these steps to learn how to import your Swyftx data:

- Go to the site and Log in.

- After logging in, navigate to the left-hand menu by clicking on the three horizontal lines in the top-left corner of the screen.

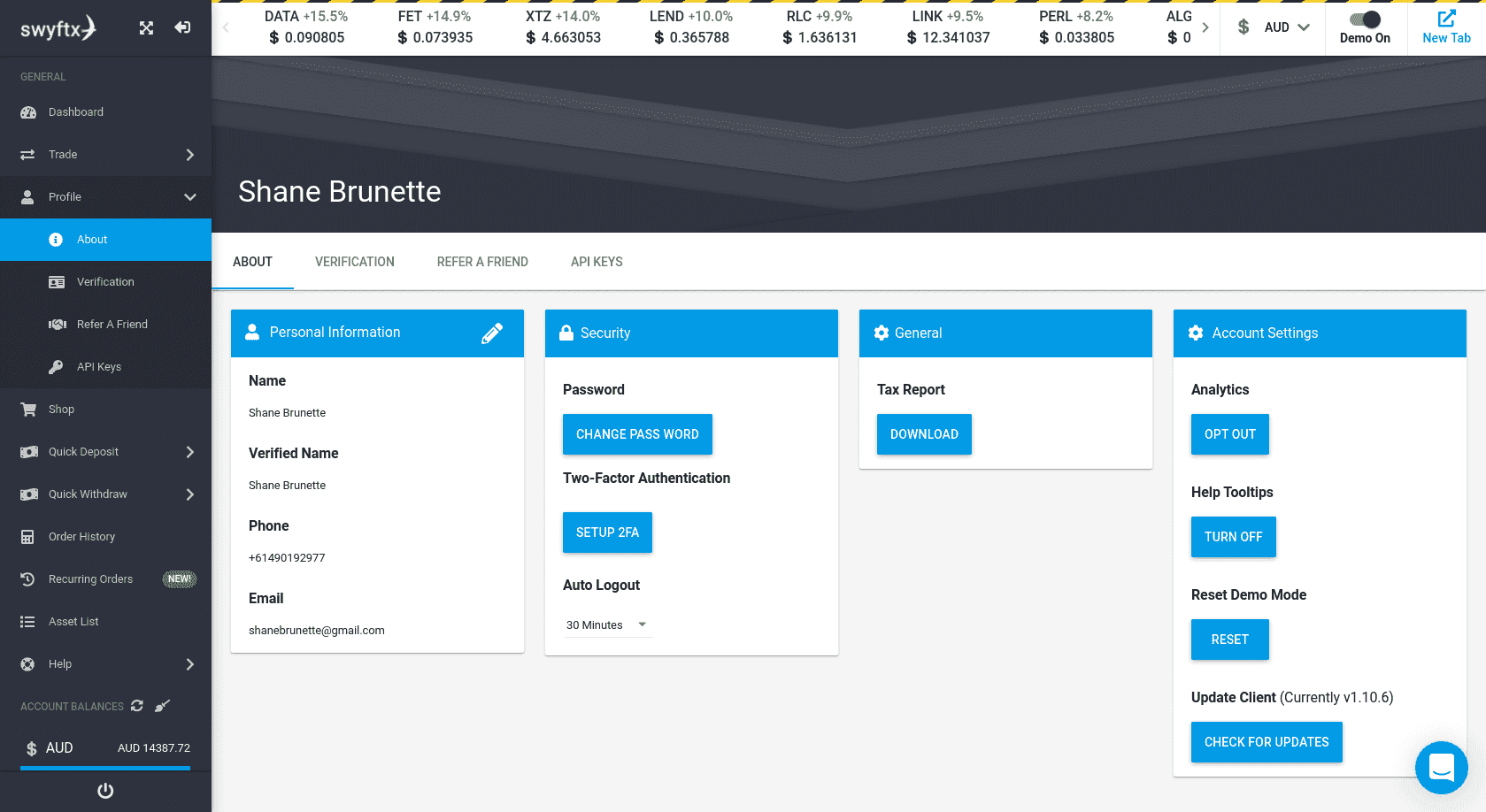

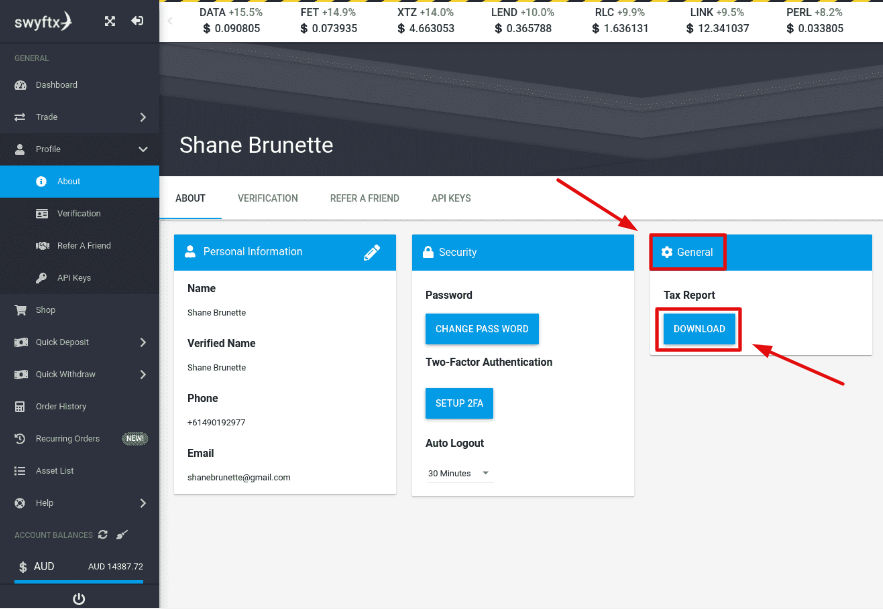

- Click on the “Profile” tab to access your profile information.

- From the “Profile” tab, select “About” and then “General.”

- Click on “Tax Report” to view your tax report options.

- Choose the appropriate tax report based on your needs and click “Download.”

- When prompted, select the entire date range of your Swyftx trading activity to ensure that all relevant information is included in the report.

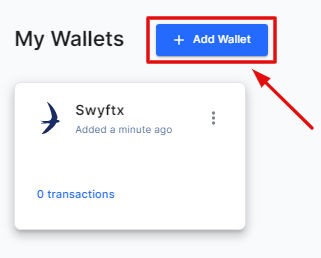

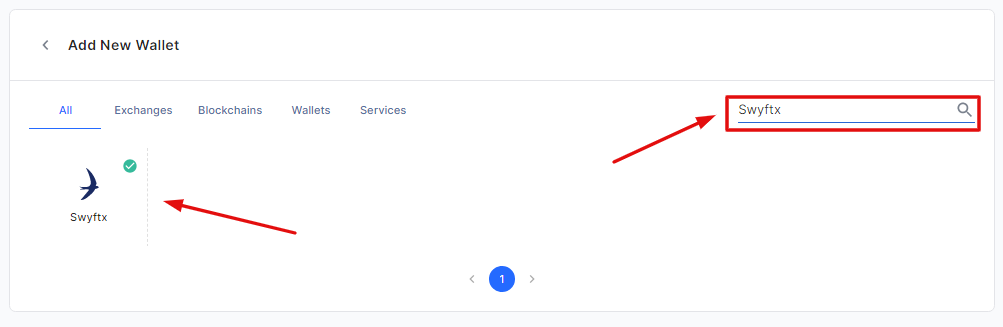

- After downloading your tax report from Swyftx, sign up for a Crypto Tax Calculator if you haven’t already done so.

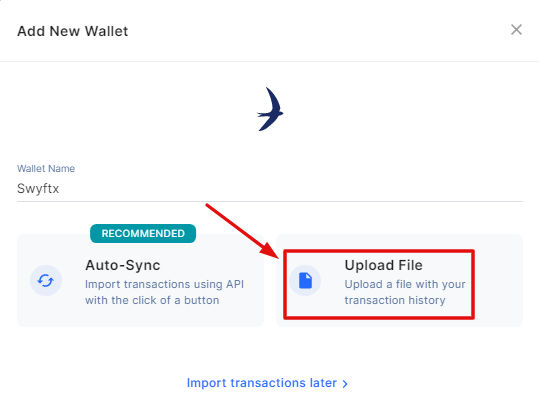

- Once you have signed up, search for Swyftx in the drop-down menu.

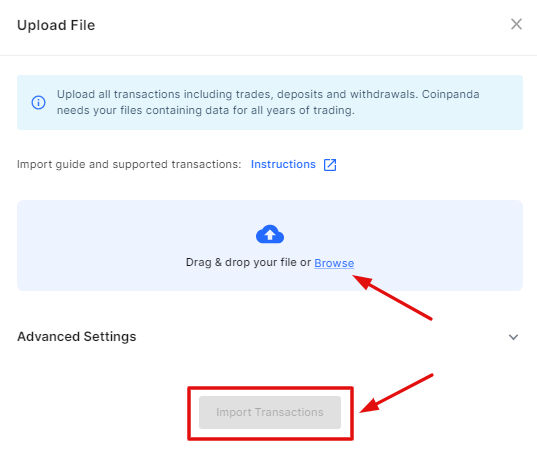

- Click on the “Browse” button and select the CSV file you downloaded from Swyftx.

- Click the “Upload” button to upload your CSV file to the crypto tax calculator.

- Go to the “Review Transactions” tab and verify that all your crypto transactions are accounted for. If you notice any missing transactions, you can manually add them to the calculator.

- Finally, navigate to the “Generate Report” tab and select the financial year for which you need the report.

- Download the report and send it to your accountant for tax filing purposes.

How to create and use API keys on Swyftx

- Sign into your account

- Click on ‘profile’ then scroll down and select ‘API keys’, profile can be found at the upper left corner of the homepage

- Go through warning message, and select ‘I Understand’

- Copy the generated ‘API key’ and ‘Access Token’ to your clip board, and paste then into your crypto tax calculator

Swyftx fees

Swyftx is a trading platform that offers its users the ability to withdraw and deposit AUD currency without incurring any fees. In addition, Swyftx charges a standard trading fee of 0.6%, which can be discounted for users who trade in high volumes. It’s important to note that Swyftx does not charge any deposit or withdrawal fees. However, traders will still be responsible for paying the standard network fee when making transactions on the platform.

How does Swyftx Tax work?

Cryptocurrency investment comes with tax liabilities: Income Tax or Capital Gains Tax (CGT). The specific type and amount of tax payable will depend on various factors of the transaction, including the type of transaction and the entity making the transaction, such as an individual or business.

Capital Gains Tax is the tax paid on the profit from selling a capital asset. In cryptocurrency, a capital gain or loss is determined by subtracting the cost base (the price it was purchased for) from the capital proceeds (the price for which the asset was sold). Different cryptocurrency transactions may lead to a ‘Capital Gains Tax Event’ and require payment of CGT. Once the taxable amount is determined, the tax payable will be calculated based on the individual’s income tax bracket.

Swyftx provides a comprehensive Crypto Tax Guide to help you understand how taxes on cryptocurrency are calculated. It is important to note that tax laws can be complex, and seeking professional advice when dealing with cryptocurrency taxation is always advisable.

The process of meeting tax obligations can be simplified by maintaining accurate and comprehensive records of your cryptocurrency activities. These records can provide valuable insights into cash flow and overall performance, so it is especially important for businesses,.

To ensure compliance, you may consider working with an accountant or utilizing third-party software to help manage your record-keeping requirements and calculate your taxes.

However, the sheer volume of record-keeping requirements can be overwhelming. For example, recording a trade between Bitcoin and Ethereum requires documenting both sides of the transaction and reporting any applicable taxes. This process can be extremely time-consuming if done manually, which is where a crypto tax calculator can help by automating the process for you.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.