How to calculate tax on AscendEX – BitMax

Crypto tax calculators allow people to enumerate their taxes without any hassle when they trade on AscendEX – BitMax. By importing your transaction data in CSV format or through the API, there is a tool that converts the data to your local currency automatically. With the inventory methods, you can effortlessly calculate both your short-term and long-term gains for the fiscal year. Making AscendEX tax assessment a lot easier.

How do I use my API key to import AscendEX data?

- Open your web browser and navigate to the AscendEX website.

- Enter your AscendEX credentials to sign in to your account.

- Once you are logged in, locate the avatar icon in the upper right-hand corner of the screen and click on it.

- In the drop-down menu, select the “API Setting” option.

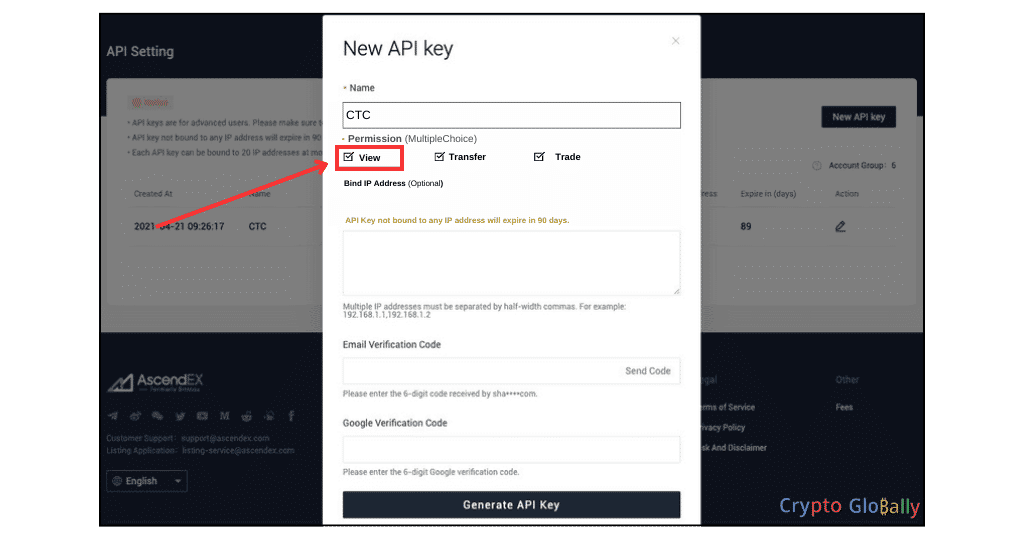

- On the “API Setting” page, click on the “New API key” button.

- You will be prompted to enter your two-factor authentication code. Once you have entered it, click “Confirm”.

- You will now see a form that allows you to configure your API key. Make sure that the “View” permission is checked, as this will allow you to view your account information via the API.

- Once you have confirmed that the “View” permission is checked, click the “Generate API key” button.

- You will now see your newly generated API key and API secret. Make sure to copy these values and store them in a secure location, as you will need them to authenticate your requests to the AscendEX API.

- Then choose sync after copying the generated API key.

How do I use CSV to import AscendEX data?

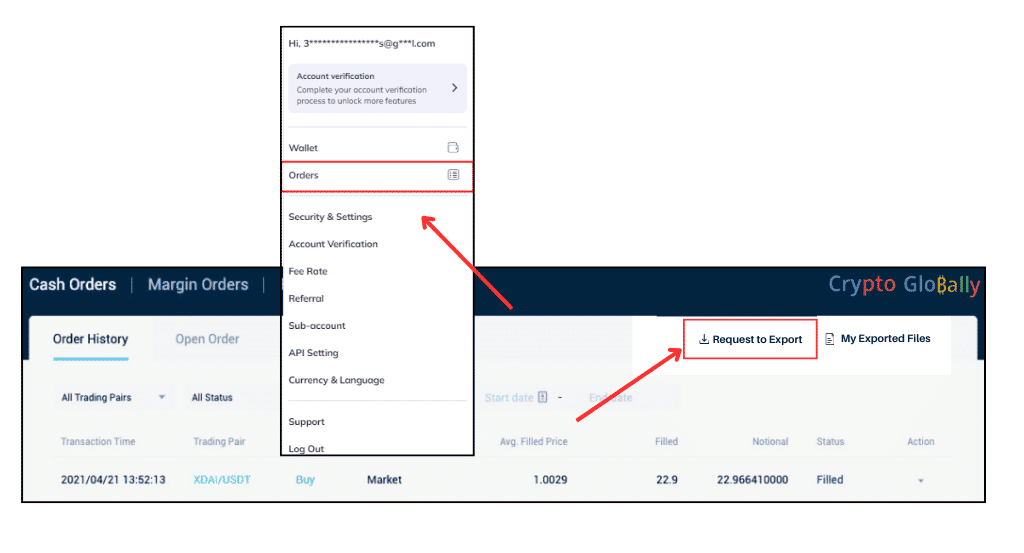

- Log in to your AscendEX account.

- Click “My Order” in the top menu.

- Select “Request to Export”.

- Confirm the export request.

- Download the file by clicking the “My Exported Files” icon on the right.

- Open the file in a spreadsheet software to view your order history.

AscendEX fees

AscendEX makes use of a VIP-level structure system to determine the fee for spot trading and futures trading. The VIP level structure for spot trading and futures trading is different, but they are both determined by the user’s trading volume and holdings. In this system, higher VIP tiers pay fewer fees.

Withdrawal and Deposit fees

| Currency Name | Withdrawal fee | Deposit Fee |

| Bitcoin (BTC) | 0.0005 BTC | No deposit Fee |

| AscendEX token (ASD) | 400 ASD | No deposit fee |

| Ethereum (ETH) | 0.005 ETH | No deposit fee |

| Solana (SOL) | 0.5 SOL | No deposit fee |

| BNB (BNB) | 0.005 BNB | No deposit fee |

| Cardano (ADA) | 3 ADA | No deposit fee |

| Polkadot (DOT) | 0.17 DOT | No deposit fee |

| Dogecoin (DOGE) | 10 DOGE | No deposit fee |

| LINK (LINK) | 3.2 LINK | No deposit fee |

| Ripple (XRP) | 2 XRP | No deposit fee |

| Stellar Lumens (XLM) | 5 XLM | No deposit fee |

| SHIB (SHIB) | 2200000 SHIB | No deposit fee |

| Avalanche (AVAX) | 0.061 | No deposit fee |

| Uniswap (UNI) | 2.7 UNI | No deposit fee |

| Tron (TRX) | 15 TRX | No deposit fee |

| Gala (GALA) | 560 GALA | No deposit fee |

| Cosmos (ATOM) | 0.1 ATOM | No deposit fee |

| Bitcoin Cash (BCH) | 0.022 BCH | No deposit fee |

| Ethereum Classic (ETC) | 0.05 ETC | No deposit fee |

| Harmony (ONE) | 20 ONE | No deposit fee |

| Tezos (XTZ) | 1 XTZ | No deposit fee |

| Polygon (MATIC) | 2 MATIC | No deposit fee |

| Litecoin (LTC) | 0.05 LTC | No deposit fee |

How does AscendEX tax work?

Bitmax, now known as AscendEX, is a crypto exchange that is used all over the world. The tax regulations that should be implemented are determined by your region of residence; it is important to know the crypto tax laws in your country.

When crypto traders on AscendEX sell their holdings at a higher price than they bought them for, they are likely subject to capital gains tax because of their profit. The tax rate for CGT is determined by various factors, such as income and profit from crypto trading. You will probably pay long-term capital gains tax, which is normally lower than short-term capital gains tax, if you keep your crypto for more than a year.

AscendEX does not help out with tax in any way; you, as a trader, will be totally responsible for tax assessments and tax returns. It is important to keep proper accounts of your crypto transactions, position sizes, prices, and any fees or commissions paid.

To make sure you’re abiding by the regulations and reducing your tax liabilities, it’s crucial to speak with a tax expert or accountant who has knowledge of cryptocurrency tax regulations.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.