How to calculate tax on CoinList Pro

When using a crypto calculator, there are several options for calculating your CoinList Pro tax. CoinList Pro features an API that allows users to automate the process of uploading their trading data to a crypto tax calculator. CoinList Pro users can also download their CSV files manually, and upload them to a tax calculator.

How to get your CSV data on CoinList Pro

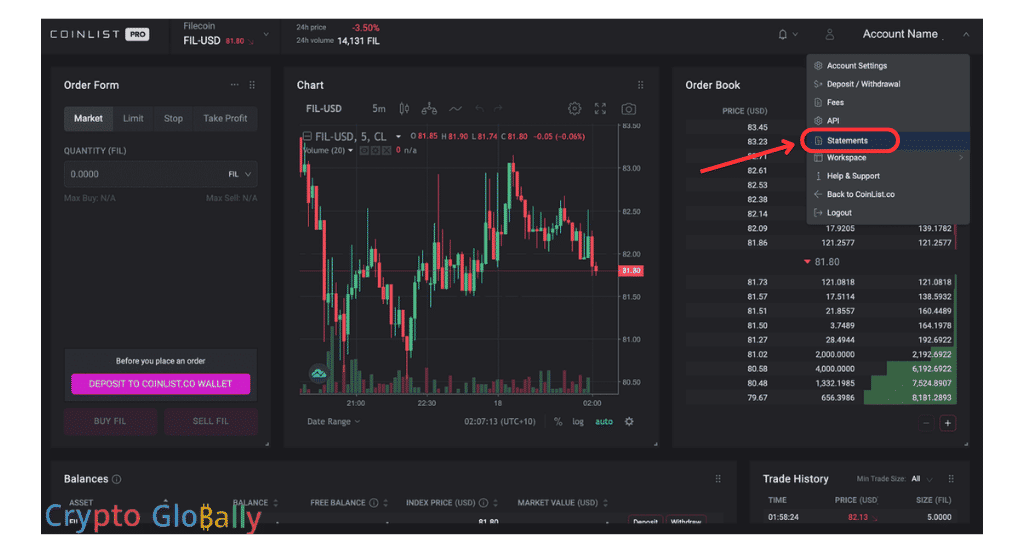

- Log into your CoinList Pro account.

- At the top right corner of your home screen, select the drop-down menu.

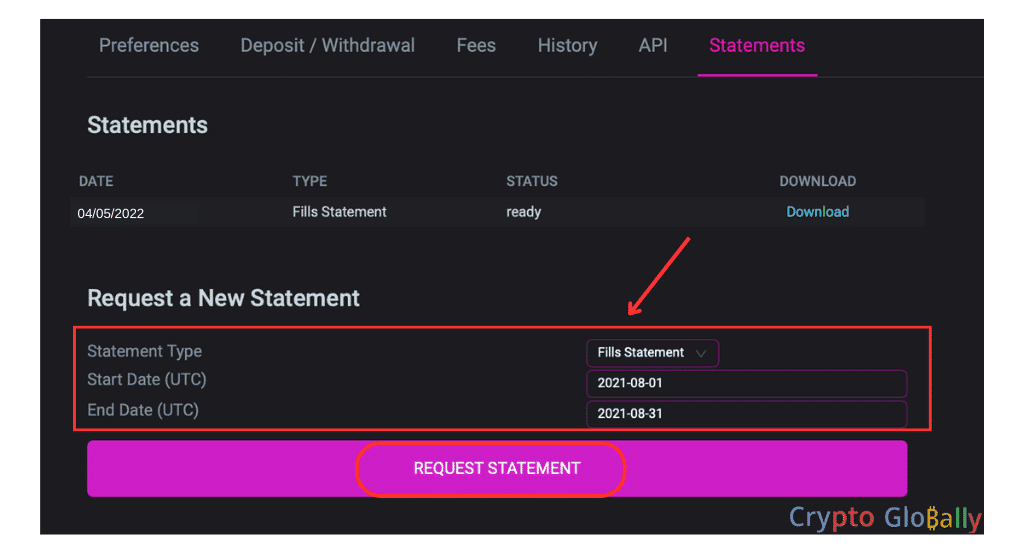

- From the list of options, select statement. Choose your statement date and statement type, then process to request a statement.

After downloading your CSV file, upload it to your crypto calculator.

How to create and use API keys on CoinList Pro

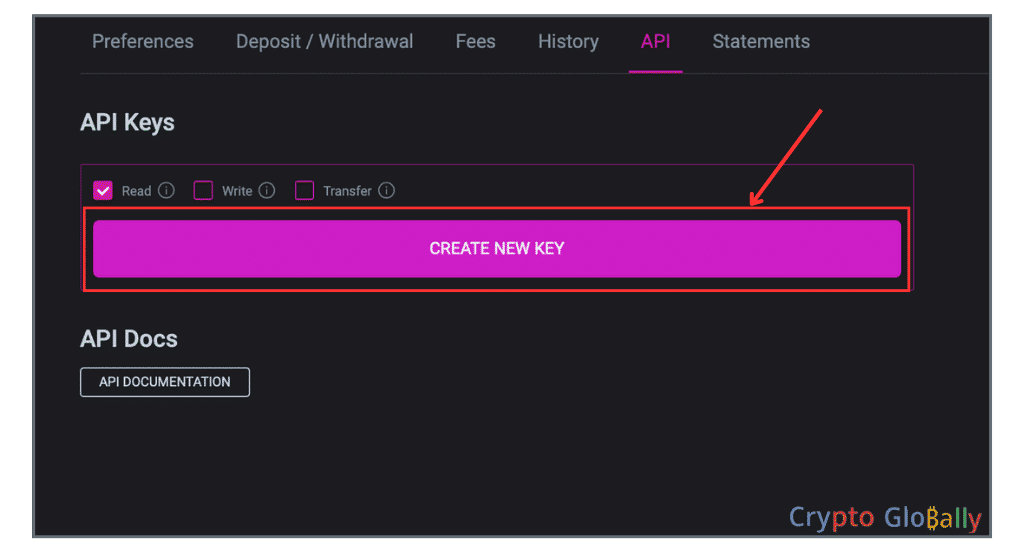

- From your homepage, navigate to the top right corner and open the drop-down menu.

- Click on “API.”

- Go through the permission terms and process to create a new key.

- Copy the newly generated API key to your clipboard, and input it into that section of your crypto tax calculator that says ‘Add API.”

CoinList Pro fees

CoinList.co charges a base fee of 0.5% for every transaction, while CoinList Pro uses a tight tier system. Trading with high volume on CoinList Pro attracts low fees.

CoinList Pro deposit and withdrawal fees

| Asset | Withdrawal fees | Deposit fees |

| Bitcoin | 0.0005 BTC | No deposit fees |

| Ethereum | 0.0040066 ETH | No deposit fees |

| Wrapped bitcoin | 0.00026832 WBTC | No deposit fees |

| Celo | 0.0015 CELO | No deposit fees |

| Tezos | 0.001 XTZ | No deposit fees |

| Compound | 0.1849600 COMP | No deposit fees |

| Chainlink | 1.032910 LINK | No deposit fees |

| Avalanche | 0.003 AVAX | No deposit fees |

| Dogecoin | 0.01 DOGE | No deposit fees |

| Polygon | 7.39533469 MATIC | No deposit fees |

| SushiSwap | 7.03806621 SUSHI | No deposit fees |

| Polkadot | 0.02 DOT | No deposit fees |

| Solana | 0.000005 SOL | No deposit fees |

| Internet Computer | 0.0001 ICP | No deposit fees |

| Aave | 0.1057790999 AAVE | No deposit fees |

| Uniswap | 1.363134 UNI | No deposit fees |

| Filecoin | 0.01 FIL | No deposit fees |

How does CoinList Pro Tax work?

CoinList Pro Tax is a tax reporting tool owned by CoinList to help CoinList users calculate taxes. This tool is integrated into some tax software providers, making it easy for users to create a tax report for their crypto-related transactions on CoinList Pro.

To enjoy this feature, users first need to import their crypto transaction data from their CoinList Pro account. This transaction data will contain all the trade, sell, and buy transactions on CoinList Pro within a specific period of time. After the crypto transaction data has been uploaded to CoinList Pro Tax, the system will automatically calculate profits and losses while taking fees into account.

After the profits and losses have been calculated, CoinList Pro Tax will generate a compliant tax report, which will be used for reporting tax returns. CoinList Pro Tax generates all reports from the data imported from your CoinList account. It is the user’s responsibility to ensure that crypto transactions are recorded properly. As a taxpayer, if you require assistance with your tax report, consult a tax professional.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.