How to calculate tax on Binance

On Binance, There are two ways to upload transaction data to any crypto tax calculator. Binance is a very simple and straightforward platform, and its API allows users to upload transaction data. Binance also gives users the option of manually downloading and uploading CSV histories.

How to get your CSV data on Binance

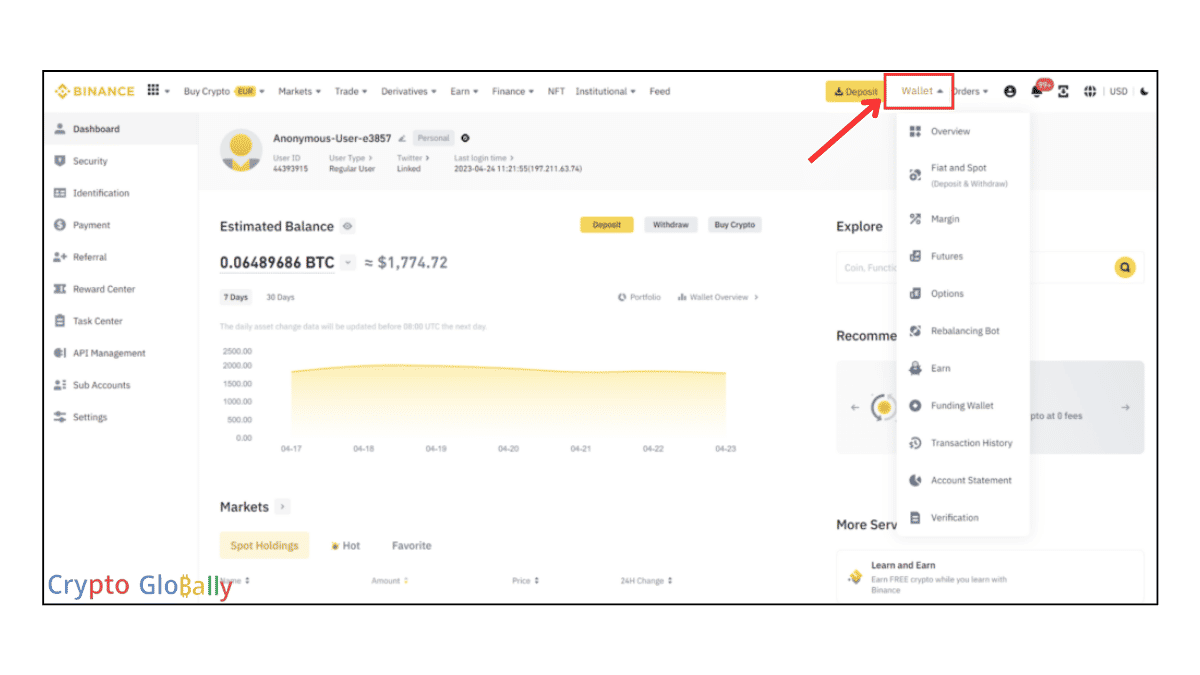

- Log into your Binance account, locate and select wallet from the top right of the home page.

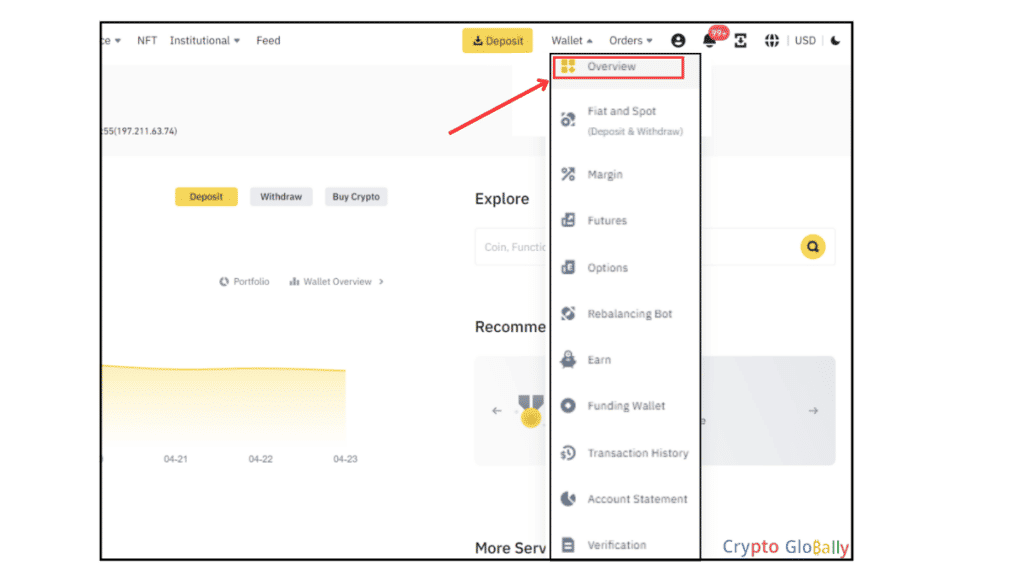

- Click on “overview” from the drop menu

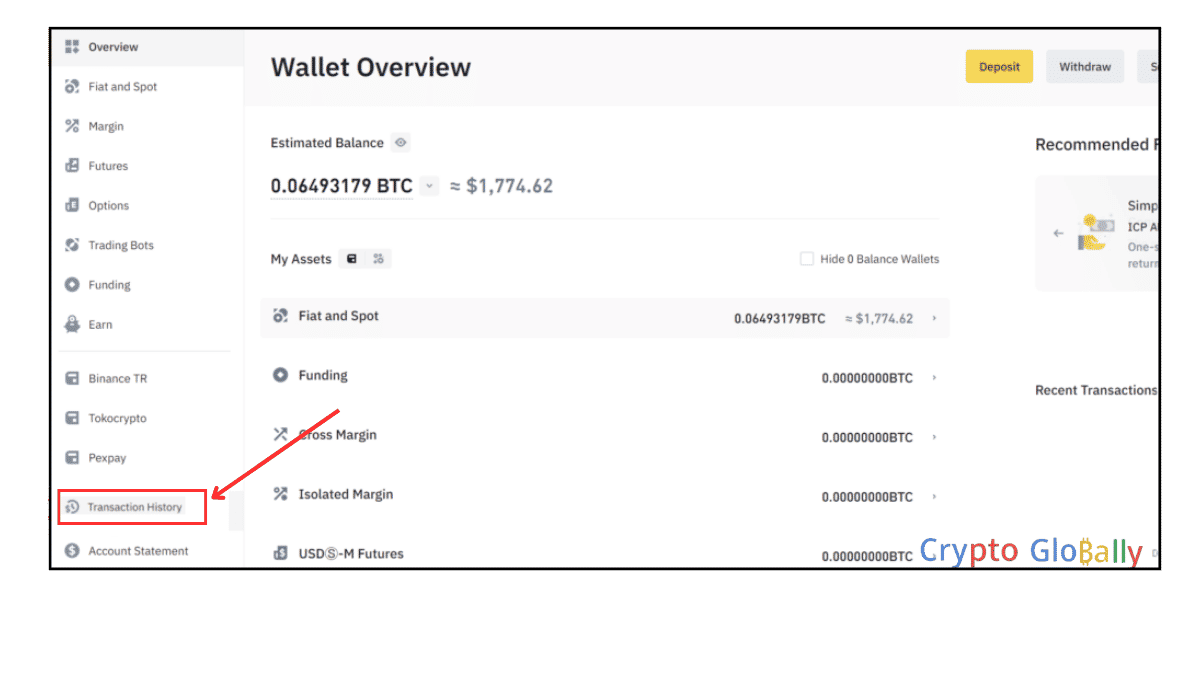

- Locate and select transaction history

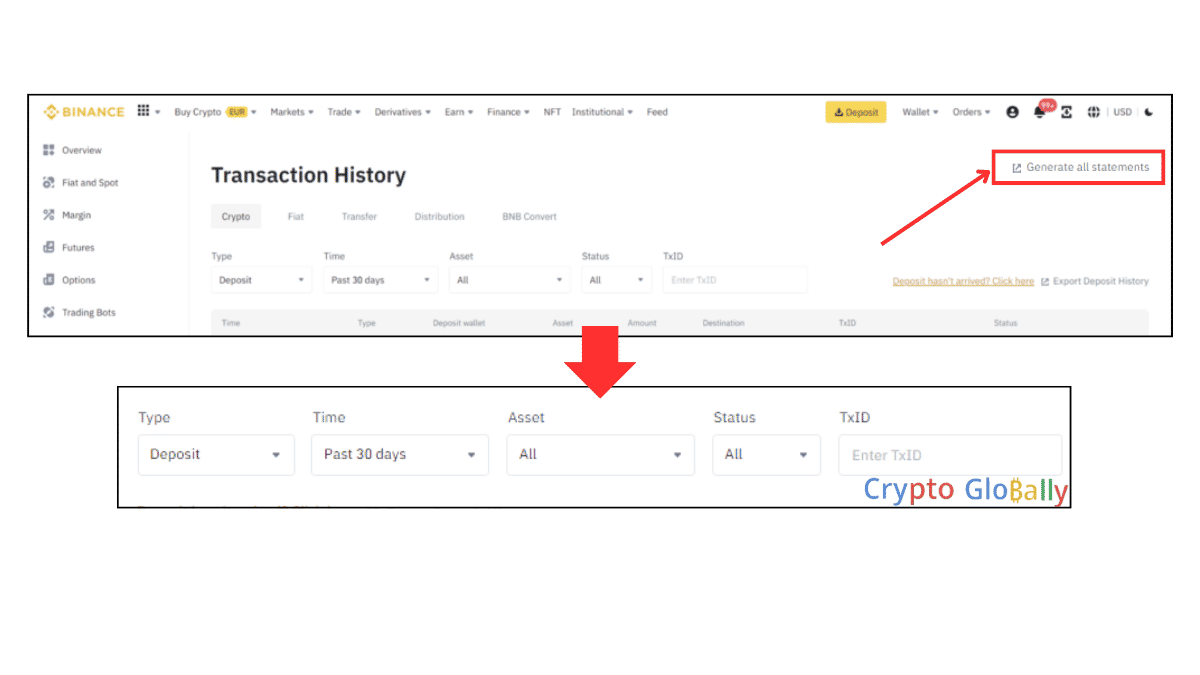

- From the top right corner, select “generate all statements.”

- Choose your preferred start and end dates, and be sure to hide your transfer records.

- When you are done, click on Generate.

When the CSV file is downloaded, it should be imported into your crypto tax calculator.

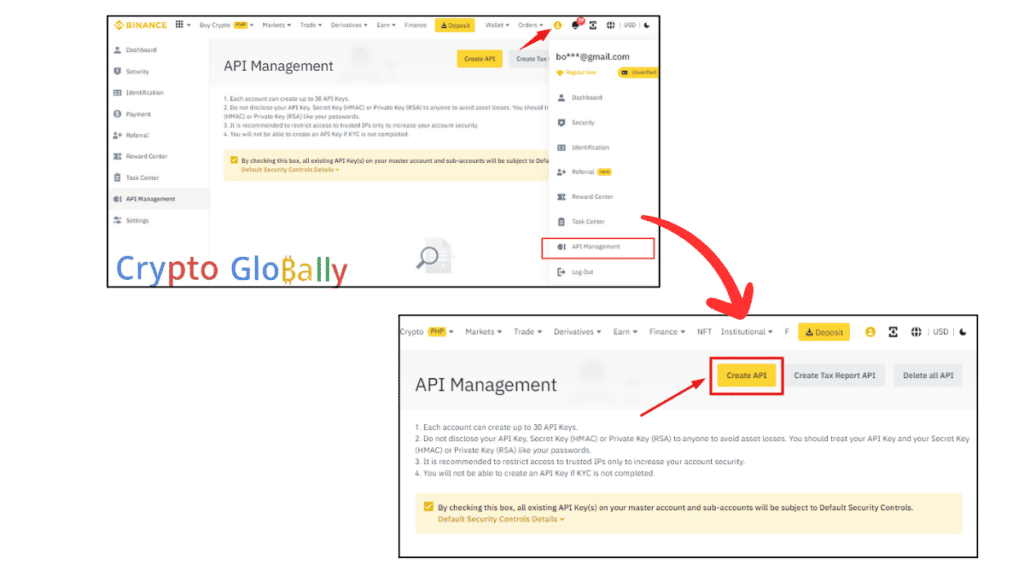

How to create and use API keys on Binance

- Log into your Binance account.

- From the top right of your screen, click on your profile avatar and select ‘API Management’.

- Create a new API and label it

- You may be required to verify your account to continue. When the API is created, copy the secret key and the API key to your clipboard.

- On your crypto tax calculator, you can use the copied keys to sync data.

Binance Fees

Like several crypto exchanges, Binance makes use of a VIP tier fee system. This means that not all traders pay the same fees, and traders are ranked based on their trading activity. As you climb up the VIP tier, you pay less in fees. Spot and futures trading have their own unique VIP tier fees.

Crypto withdrawal and deposit fees on Binance

| Token | Network | Withdrawal fee | Deposit fee |

| 1inch (1INCH) | BEP20 – ERC20 | 0.32 – 26 | No deposit fee |

| Audius (AUDIO) | ERC20 | 42 | No deposit fee |

| Cardano (ADA) | BEP20 – Cardano – BEP2 | 0.5 – 10 – 0.84 | No deposit fee |

| Cosmos (ATOM) | BEP20 – Cosmos – BEP2 | 0.014 – 0.01 – 0.03 | No deposit fee |

| Aave (AAVE) | BEP20 – BEP2 – ERC20 | 0.0022 – 0.0046 – 0.19 | No deposit fee |

| Avalanche (AVAX) | BEP20 – Avalanche – AVAX C-chain | 0.01 – 0.1 – 0.1 | No deposit fee |

| Bitcoin Cash (BCH) | BEP20 – Bitcoin cash – BEP2 – ERC20 | 0.0014 – 0.002 – 0.0028 – 0.11 | No deposit fee |

| BNB | BEP20 – BEP2 – ERC20 | 0.01 – 0.01 – 0.012 | No deposit fee |

| Binance USD (BUSD) | BEP20 – AVAXC-Chain – BEP2 – ERC20 – optimism – polygon – TRC20 | 9 – 10 – 10 – 40 – 10 – 10 – 10 | No deposit fee |

| Bitcoin (BTC) | BEP20 – Bitcoin – BEP2 – SegWIt – ERC20 | 0.0000078 – 0.0003 – 0.000012 – 0.001 – 0.00048 | No deposit fee |

| PancakeSwap (CAKE) | BEP20 – BEP2 | 0.046 – 0.1 | No deposit fee |

| Polkadot (DOT) | BEP20 – DOT – BEP2 | 0.028 – 1.5 – 0.056 | No deposit fee |

| Dogecoin (DOGE) | BEP20 – BEP2 | 2.2 – 4.18 | No deposit fee |

| Ethereum (ETH) | BEP20 – ERC20 – BEP2 | 0.00011 – 0.0098 – 0.00018 | No deposit fee |

How does Binance tax work?

Cryptocurrency traders are subject to the tax laws and regulations of their country of residence. Every country has its own laws, so it is important to be fully aware of the tax laws of your country of residence. Binance tax is dependent on several factors, like the type of crypto transactions made, the country of residence, and the trader’s profit or loss.

In most nations, cryptocurrency is subject to capital gains tax. This implies that profits made in any crypto transaction on Binance are considered taxable, and losses will also be taken into consideration when calculating taxes. The tax you pay depends on the tax laws governing your region.

It is critical to keep proper records of all your crypto transactions on Binance, as it could help with your tax assessment or tax returns. There may be some penalties or fines from tax authorities when tax laws are disobeyed.

The process of Binance tax reporting can be complicated at times. If you are having issues, it is best to consult a tax professional for further guidance.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.