How to calculate tax on Voyager

The initial stage of initiating your voyager tax procedure involves transferring your wallet transactions to a crypto tax calculator. By synchronising your transactions using your wallet address, you can seamlessly integrate Voyager with a supported crypto tax calculator. The instructions below show how to upload your Voyager transactions.

How do I import transactions into a crypto tax calculator from Voyager?

Follow these steps:

- Go to the Voyager Tax website and sign in to your account using your username and password.

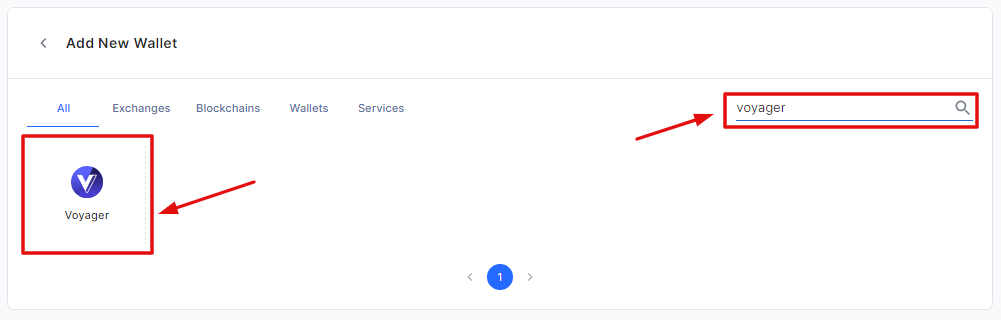

- Once you’ve logged in, navigate to the “Import Data” tab on the app.

- From the list of options, select “Voyager” to begin importing your transaction history.

- You will be prompted to provide your Voyager wallet address(es) that you have used during your engagement with the platform.

- After uploading the CSV File(s), import the transaction history.

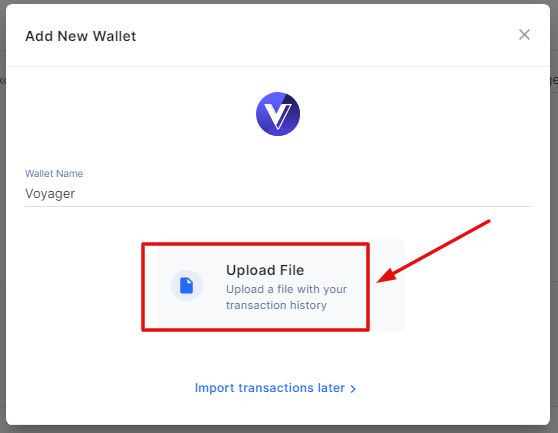

- Once you’ve provided all the necessary information, click on the “Upload File” to initiate the import process.

- The app will begin importing your transaction history from Voyager, which may take some time depending on the number of transactions.

- After the import is complete, the app will display your transaction history, including your capital gains, losses, and/or income from your Voyager transactions.

- Review your transaction history to ensure that all your transactions have been accurately recorded and that there are no unresolved transactions.

- If there are any unresolved transactions, you can manually enter the missing information in the app to ensure that your tax report is accurate.

It is important to note that if transactions have been carried out on several chains, you must input the appropriate wallet address(es) for every chain you interact with.

Voyager Fees

Voyager has quickly become a very popular crypto trading platform used by various types of traders and investors. This trading platform has a user friendly interface and a very low investment requirement. Users can start trading and investing with a minimum of $10, which is a good deal when compared to other crypto exchanges.

Voyager does not charge anything for trade executions, meaning trading on Voyager is free. They generate revenue by facilitating the purchase of cryptocurrencies for users on the most economical and advantageous exchanges.

This exchange does not require a minimum account balance, and it allows for bank transfers of up to $5,000 per transaction. There is a fixed fee of $50 for every wire transfer. Voyager prioritises providing the most favourable exchange rates for users, while returning savings amount. There is a percentage fee for savings on Voyager.

Voyager’s profitability is contingent on ensuring that users save the most possible in the process. This means that users can effortlessly use the service to conduct buy and sell transactions on the go.

How does Voyager Tax work?

Voyager follows the appropriate tax regulations and laws in every region of operation. This exchange also provides users with resources and tools to help track and report taxable activities like transactions and trades. The exchange supports a straightforward tax centre, which can be found on the website. The tax centre allows users to download reports from their transaction history.

Users have the option of integrating Voyager directly with well known tax software. This makes the process of reporting taxes a lot easier, therefore encouraging users to comply with tax laws. It is worth noting that cryptocurrency tax laws vary in different jurisdictions; wherever you may find yourself, it is important to familiarise yourself with the regulations of that country.

Tax regulations and laws can change at any time and vary based on several factors. It is vital to consult a tax professional if you have any questions. This will help ensure you are adhering to the appropriate tax requirements.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.