How to calculate tax on Tron

Some crypto tax calculators have integrated support for tron tax (TRX) Tron is a very popular decentralised platform, with the primary goal of making digital sharing and payments very affordable.

Tron users often encounter problems when trying to estimate their tron tax liabilities for TRX transactions. Making use of a crypto tax calculator can help make the process of calculating your tax liability easier, automating tax calculation gives less room for errors. Some tax calculators are integrated directly into the tron network.

Below is a step to step guide on how to automate the importation of all your tron transactions.

- Open your Tron wallet and copy your Tron address to the clipboard of your mobile device. You can usually find your Tron address in the settings or account section of your wallet.

- Open your preferred crypto tax calculator in your web browser or mobile app. If you don’t have a tax calculator yet, you can choose from one of the many available options online.

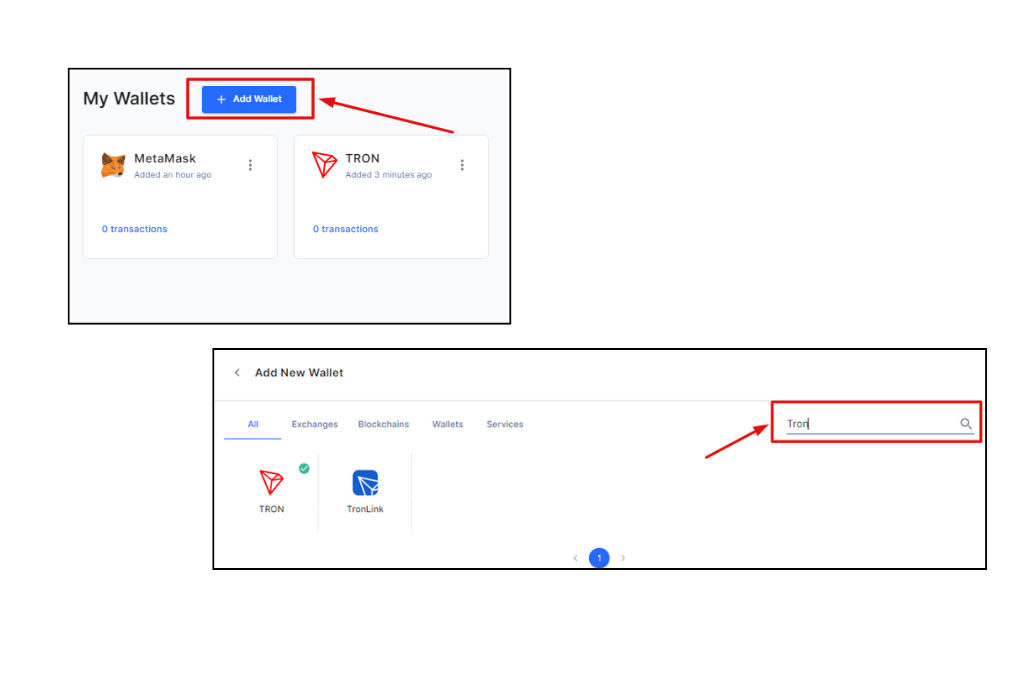

- Once you’re logged in to your tax calculator, look for the “import data” option in the menu or on the dashboard. Click on this option to begin importing your Tron wallet data.

- In the search bar, type “Tron” or select it from the list of available cryptocurrencies. This will bring up the Tron wallet import page.

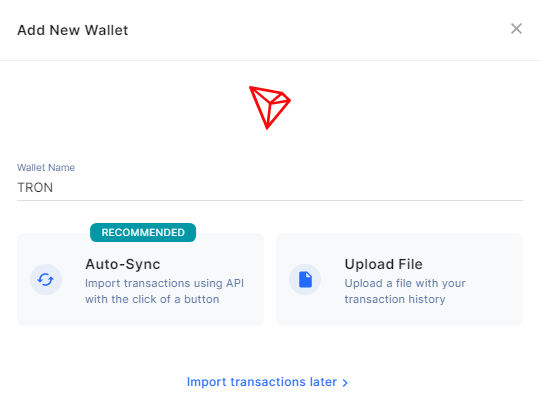

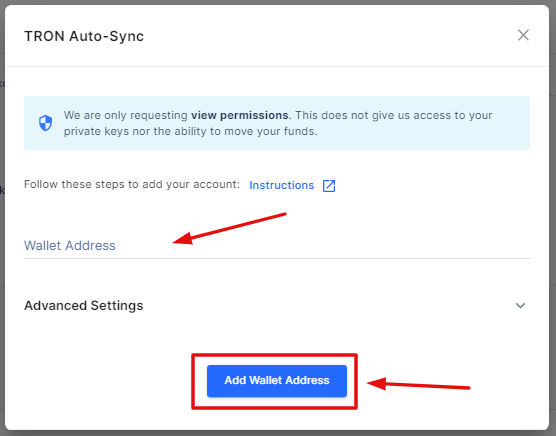

- On the Tron import page, you will be prompted to enter your Tron address and a nickname for your wallet. This nickname can be anything you choose and is simply a way to identify your Tron wallet within your tax calculator.

- After you have entered your Tron address and nickname, select the “Add Wallet” button to synchronize your Tron wallet with your tax calculator.

- The tax calculator will now begin synchronizing your Tron wallet data. This process may take a few minutes, depending on the amount of data you have in your wallet.

- Once the synchronization is complete, you should see a green checkmark or other indicator that your Tron wallet has been successfully imported into your tax calculator.

- You can now view your Tron transactions and calculate your tax liability using the tools and features of your tax calculator. Be sure to review the accuracy of your imported data and make any necessary adjustments before filing your taxes.

Tron fees

Tron Network offers one of the most affordable fees out there. These fees vary in every exchange, below are some exchanges and their TRX fees.

| Exchange | Trading fee | Withdrawal fees | Deposit fees |

| Kucoin | 0.1% | 0.0665187 | No deposit fee |

| Binance | 0.1% | 0.0665187 | No deposit fee |

| EXMO | 0.1% | 0.0665187 | No deposit fee |

| Kraken | 0.16 – 0.26% | 0.0665187 | No deposit fee |

| Bithumb | 0.04 – 0.25% | 0.0665187 | No deposit fee |

| CoinDCX | 0.1% | 0.0665187 | No deposit fee |

| Bybit | 0% – 0.1% | 0.0665187 | No deposit fee |

| BitMart | 0.25% | 0.0665187 | No deposit fee |

| BTSE | 0.1% – 0.12% | 0.0665187 | No deposit fee |

| Bitfinex | 0.1% – 0.2% | 0.0665187 | No deposit fee |

| Huobi | 0.2% | 0.0321938 | No deposit fee |

| OKEx | 0.08% – 0.1% | 0.0000000 | No deposit fee |

| Coinone | 0.01% | 0.0000000 | No deposit fee |

| MXC.com | 0.2% | 0.0665187 | No deposit fee |

| 50x | 0.2% | 0.0665187 | No deposit fee |

How does Tron tax work?

Tron tax works similarly to how other cryptocurrency taxes like Ethereum (ETH), and Bitcoin (BTC) work. Tron is taxable in a lot of countries. The amount you owe as a tax on Tron depends on several factors like the duration of time the cryptocurrency was held, the cost of acquisition, and your tax bracket. Most countries levy a higher tax on cryptocurrencies that were held for less than a year compared to holdings of over a year.

Cryptocurrency taxes in most countries are considered a capital gain taxes. If you sell your TRX for a higher price than you bought it, you will be subject to CGT (Capital Gain Tax).

It is crucial to keep in mind that tax laws around cryptocurrencies are subject to changes, and these laws vary in every country. Taxpayers should consult a tax expert for more information on tax obligations, and legal ways to reduce tax burdens. It is important that taxpayers comply with the laws and regulations they are subjected to.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.