Since the introduction of Bitcoin in 2009, the mass adoption of decentralised finances as a replacement for traditional financial systems has been a reforming idea. Numerous DeFi projects are pushing for a complete transition to crypto, but the change can only happen gradually, as many people still rely on fiat.

To solve this problem, the financial services platform Square plans on launching a new project called tbDEX. The revolutionary platform works as a protocol for a decentralised exchange, which aims to build bridges between fiat and cryptocurrencies to bring decentralisation to the financial systems.

Learn how you can benefit from Square’s new project, how it works, and how it may speed up the mass adoption of DeFi.

Key Takeaways:

- Square’s tbDEX is its newest project, building a decentralised exchange that will help accomplish its goal to make the decentralised financial world accessible for everyone.

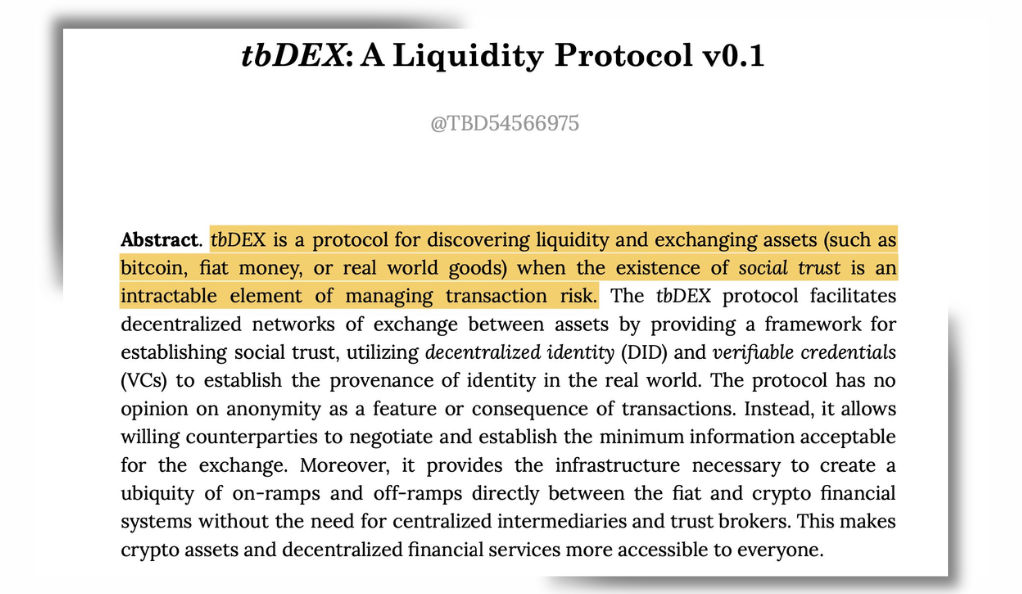

- tbDEX is a protocol for discovering liquidity and exchanging different asset classes with the help of revolutionary technology based on social trust.

- The technology behind tbDEX’s platform lies in an advanced transparency model, decentralised identity (DID), verifiable credentials (VC), decentralised web nodes, and a core messaging protocol.

- Although risks and uncertainties remain on their way, and the release date of the exchange is yet to be announced, the development team stays loyal and dedicated to their vision.

What Does Decentralised Finances (DeFi) Mean?

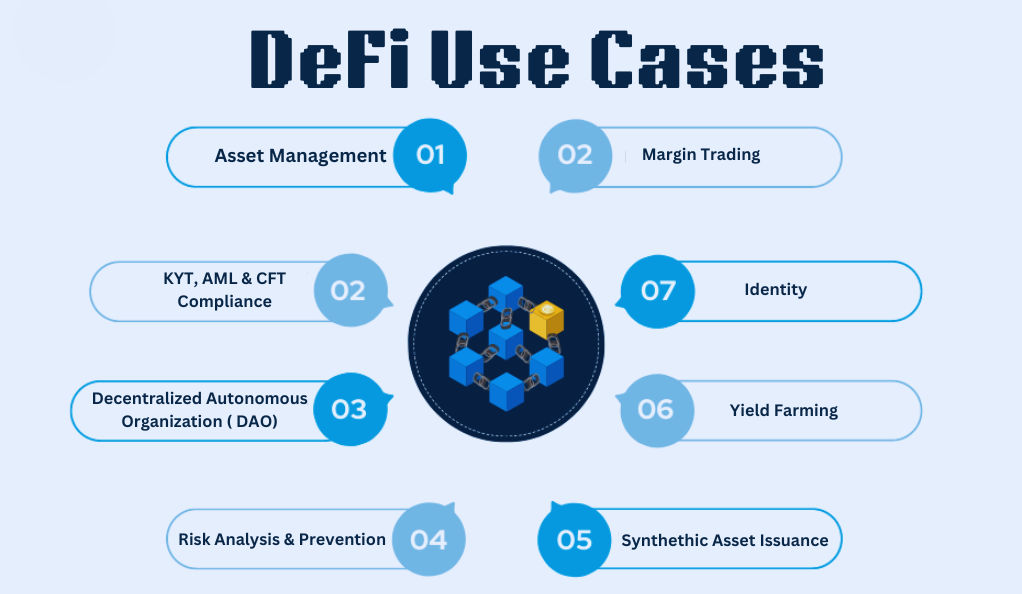

Whether you are new to cryptocurrencies or not, you have probably heard about the emerging concept of decentralised finances, also known as DeFi. Decentralised finances is a new and revolutionary financial model based on distributed ledger, the same technology that cryptocurrencies utilise.

Let’s compare DeFi to traditional financial institutions to understand the concept better. Banks, brokerages, and exchanges are all centralised institutions, meaning you will rely on a central authority when dealing with your finances.

Decentralised finances challenge this idea by removing third parties and giving access to financial services to everyone with an internet connection. Furthermore, using blockchain technology, DeFi platforms are more transparent, charge less fees, and are more time efficient. Most importantly, they are decentralised, meaning users have complete control over their finances.

Now that we have the basics about DeFi out of the way, let’s delve into the core of tbDEX, the vision behind the project, and how it functions.

Introducing tbDEX – A Decentralised Exchange that Builds on Social Trust

Square, the financial services platform for small, medium, and large businesses, needs no introduction. However, its new division, TBD, is an abstract approach to Square’s traditional services. TBD is created to develop non-custodial and decentralised financial services, and this exact project will be building tbDEX.

tbDEX is an open developer platform and a protocol for discovering liquidity and exchanging assets. The platform uses Decentralised Web Nodes, decentralised identity (DID), and verifiable credentials (VCs) to establish social trust. If these terms don’t ring a bell, don’t worry; we will dig deeper into the technology behind the project a bit later.

We will first explain what tbDEX is by presenting its two main concepts: being decentralised and being an exchange. Popular crypto trading platforms like Binance, Coinbase, Crypto.com, etc. are centralised exchanges. “Centralised” means that the platform is controlled by financial intermediaries, meaning you must pay high transaction fees and rely on third parties for your assets and finances. What is more, these exchanges still need to manage to connect traditional finances and cryptocurrencies.

As a result, TBD creates a decentralised solution in the face of tbDEX. The protocol functions on anonymity and trust between counterparties. Blockchain participants interact with each other and their transactions to negotiate the needed level of transparency. The decentralised exchange is controlled by participants and trusted third parties when required, eliminating the need for centralised interference.

Therefore, fees are calculated based on the level of transparency the issuer wants for the transaction; at maximum anonymity, users will pay higher transaction fees. However, if the transaction is widely available for participants, substantially lower costs will be delegated.

In its exchange capabilities, tbDEX provides liquidity between different asset classes, including cryptocurrencies, stablecoins, and fiat money. Its innovative infrastructure built on trust allows users to on-ramp and off-ramp between traditional services and decentralised exchanges without intermediaries.

What is the Idea Behind tbDEX?

To be one of the pioneers in the creation of an open, decentralised financial system, that connects people from all over the globe. Around 1.7 billion adults lack access to banking systems due to a lack of infrastructure to access them, high costs, and other barriers that traditional finances oppose. The developers of tbDEX are determined to reshape the future of finance and make it accessible for everyone globally.

To showcase their idea, TBD wrote: “The tbDEX protocol aims to create ubiquitous and accessible on-ramps and off-ramps that allow the average individual to benefit from crypto innovation.”

Goals and Vision

Square has an ambitious vision for tbDEX, and although many regulatory uncertainties remain, they intend to make decentralised finances a reality. Here is a sum up of all the goals that push the development of the revolutionary protocol:

- Make financial systems accessible to everyone around the world with an internet connection.

- Give users freedom and complete control over their finances without relying on centralised institutions.

- Speed up the adoption of decentralised finances in a healthy and mutually appealing way.

Still, you have yet to discover how the technology behind tbDEX works and how it will make the goals a reality. In the next section, you will form a better understanding of the technologies and functions behind tbDEX.

Explaining How tbDEX Works

The tbDEX platform is different from your standard decentralised exchange. It builds on an already established model like PKI for security but enhances the user experience with advanced infrastructure. Below, we have outlined the main building components of the tbDEX protocol:

The Trust Model

At the core of the messaging protocol’s design lies the formation of trust between so-called “Issuers of Verifiable Credentials” related to platform users. The protocol is not regulated by any central body, federation, or a third party and instead lets the participants decide on the level of tolerable risk for processing transactions. What is more, the platform will not rely on a governance token. Counterparties will negotiate the levels of trust between each other, thus building a mutually agreed pricing system.

Understanding DIDs and VCs

Decentralised Identifiers (DIDs) are a way to tell whether a particular counterparty is legit by verifying its identity once again in a decentralised fashion. DIDs are linked to documents containing data files with cryptographic technology that enables trustworthiness between parties.

Verifiable credentials (VCs) are an advanced data processing method that ensures more safety, security, and privacy through machine learning. DIDs and VCs are the building components of the protocol that aim to build a framework for social trust.

The Protocol

The tbDEX protocol is a messaging protocol between Participating Financial Institutions (PFIs) and the wallets of issuers of VCs (any organisation or individual). The Request For Quote (RFQ) messaging protocol and point-to-point (PtP) negotiation protocol are the two components responsible for the communication.

In simple terms, the RFQ sends a message to the PFI to negotiate a deal for a fiat-to-cryptocurrency transfer. After that, the PtP comes in and allows for the secure execution of the agreement between the wallet and the PFI.

The functionalities behind tbDEX are tough to grasp, as we’ve touched on them briefly, but you can learn more from the project’s whitepaper. Nevertheless, you may be excited about the innovative exchange and want to try it. It would be best to wait patiently as the project is still under development. Read on to find out what we know about how it has progressed so far.

Where is tbDEX Now?

The story began when tbDEX published its whitepaper in 2021 and released it on Gifthub so the community can contribute to the project’s development. After the release of the whitepaper, the CEO of Square, Jack Dorsey, tweeted, “We’ve determined @TDB54566975’s direction: help us build an open platform to create a decentralised exchange for #Bitcoin.”

Following the announcement that TBD developers are working on tbDEX, no major press releases have outlined progress regarding the development process. On June 10, 2022, TBD shared a tweet on their Twitter channel, announcing they are working on the new era of the internet called Web 5.0. It will be a combination of Web 2.0 and Web 3.0, enabling decentralised apps and protocols, thus speeding up the release of tbDEX.

What About tbDEX’s Expected Release Date?

TBD’s media portal and any central news channel have yet to share information regarding the official release date of tbDEX. If you are an enthusiast eagerly awaiting the revolutionary exchange’s release, you can follow the project’s social media channels to be the first to learn about its advancement.

Risks and Uncertainties Lying Ahead

Building a revolutionary product like tbDEX, especially in a newly emerging space like DeFi, is challenging. Square’s TBD team will face many difficulties, as the following legal risks and other uncertainties may reshape or cancel the project’s progress:

- Regulatory Uncertainties from Financial Institutions

- Competition in the Face of Other DeFi Projects

- Financial Crimes, Chargebacks and Fraud

- Wallet Difficulties like Phishing and Non-Delivery of Funds

The platform is already designed with numerous safety features, including AML, blockchain monitoring, and more. Still, solutions regarding the above mentioned concerns will be released in future variants of the whitepaper.

Conclusion

Square’s tbDEX could prove itself to be a groundbreaking project in the world of decentralised finances. The project has a straightforward vision: By bridging the gap between fiat and cryptocurrencies, tbDEX aims to democratise access to financial services, giving access to banking solutions to individuals globally. The platform’s whitepaper suggests that developers have the goals, technology, and processes set in place. However, regulatory uncertainties and concerns regarding risk will remain challenges to overcome. Nevertheless, DeFi may be the future, and tbDEX and the team behind it are the pioneers dedicated to proving it.

FAQ

What is tbDEX, and how is it related to Square?

TBD is one of Square’s newest divisions that aims to develop decentralised and trustless systems, the main one being the tbDEX protocol. The project aims to create a decentralised exchange that provides liquidity for digital assets and operates with an advanced transparency system. The project’s vision is global access to Bitcoin and other cryptocurrencies for everyone and starting a pioneering decentralised financial system.

When is the expected release date of tbDEX?

The project’s whitepaper was released on 19 November 2021, when the hype surrounding the platform was exceptional. Fast forward to August 2023, and there is still no official release date for tbDEX. However, TBD shares some exciting improvements and news regarding the project, like Web 5.0 innovations and partnerships that may speed up the development process.

What real-life problems will tbDEX solve?

One of the primary purposes of tbDEX is to create a bridge between fiat and cryptocurrencies. This process will help speed up the adoption of decentralised financial services and give billions of people globally access to banking services. Moreover, finances will become much more transparent, fast, and low-cost, and users will have complete ownership of their resources without relying on third parties.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.