In the evolving landscape of blockchain and cryptocurrencies, projects like Polkadot (DOT) and Solana (SOL) have emerged as prominent players, reshaping how we perceive decentralised technologies.

This article comprehensively compares these two innovative blockchain cryptocurrencies to uncover their unique features, strengths, and potential vulnerabilities. By exploring Polkadot and Solana’s distinct design philosophies, consensus mechanisms, tokenomics, and functionalities, we aim to shed light on the fascinating interplay between scalability, security, and real-world applications.

Key Takeaways:

- The transformative world of blockchain and cryptocurrencies with a focus on Polkadot (DOT) and Solana (SOL).

- Economic efficiency, strong communities, and practical applications.

- The significance of tokens: DOT’s governance and security role, SOL as Solana’s driving force.

- Market trends: SOL’s soaring trading volume and DOT’s stability.

- Comparison Between DOT and SOL: Blockchain structures, tokenomics, and more, revealing the contrasting features of Polkadot and Solana.

- Functionalities of the Coins.

- Is it worth investing in SOL and DOT coins?

What is Polkadot?

Polkadot is a cutting-edge blockchain platform that revolutionises the concept of interoperability in the cryptocurrency landscape. Going beyond token transfers, Polkadot introduces true cross-blockchain data and asset compatibility. The platform enables seamless interaction among various blockchains within its ecosystem by operating on a unique multi-chain architecture.

Polkadot boasts exceptional economic and transactional scalability. Through a shared set of validators, it achieves unprecedented economic scalability, while distributing transactions across parallel blockchains ensures transactional scalability. A key feature is its Substrate framework, empowering developers to effortlessly create custom blockchains that integrate seamlessly with Polkadot, guaranteeing immediate interoperability and security.

With a strong focus on environmental sustainability, Polkadot employs a nominated proof-of-stake (NPoS) model, consuming minimal energy compared to traditional blockchains, resulting in a significantly reduced carbon footprint. Security is a priority, with an innovative data availability and validity mechanism that unites chains in security while preserving their independent governance.

Polkadot’s governance is decentralised, with token holders holding decision-making power over critical protocol matters. Staking DOT tokens enhances network security and offers rewards. Polkadot’s staking system prioritises decentralisation and fairness, ensuring network security through incentivization.

As an open-source project under the Web3 Foundation, Polkadot’s development involves multiple teams and developers, emphasising accessibility and collaboration. Its comprehensive approach to interoperability, scalability, and sustainable governance positions Polkadot as a pioneering force, shaping the future of blockchain technology and redefining how different blockchains can collaborate efficiently.

What is Solana?

Solana stands as a blockchain platform tailored for decentralised and scalable applications. Established in 2017 and now managed by the Solana Foundation in Geneva, the platform was developed by Solana Labs based in San Francisco.

What sets Solana apart is its remarkable transaction speed and significantly lower fees compared to competitors like Ethereum. Solana’s native cryptocurrency experienced a staggering 12,000% surge in 2021, propelling its market capitalization to over $66 billion and securing its place as the fifth-largest cryptocurrency. However, due to the strong dependence on market trends, the project lost its capitalization but continued to develop.

Solana ensures verifiable timestamps and orderly event sequences within its blockchain, operating on a proof-of-stake (PoS) mechanism augmented by its pioneering proof-of-history (PoH) concept.

With the SPL (token standard for Solana network tokens) Token akin to Ethereum’s ERC-20, Solana boasts smart contract capabilities and a PoS consensus mechanism. Its remarkable transaction speed draws attention, reaching up to 50,000 transactions per second (TPS) with an average cost as low as $0.00025.

In the dynamic cryptocurrency landscape, Solana’s advancements, versatility, and market capitalization position it as a formidable player, poised to reshape the blockchain landscape as it navigates the intricate balance between innovation and competition.

Similarities Between Polkadot and Solana

Polkadot and Solana are two innovative blockchain projects that have garnered significant attention in crypto. While they have unique features, they share several similarities that contribute to their prominence. These commonalities highlight the evolving trends and priorities in the blockchain ecosystem.

Shared Characteristics

Scalability: Both projects utilise innovative approaches to achieve high transaction throughput and quick confirmation times. Polkadot employs a heterogeneous multi-chain framework, while Solana uses parallel processing and advanced consensus mechanisms to ensure scalability.

Economic Efficiency: Polkadot’s shared security model enables multiple blockchains to utilise a standard set of validators, reducing the overall cost of maintaining secure networks. Solana’s low transaction fees and energy-efficient consensus mechanism contribute to its economic viability.

Community Engagement: Polkadot and Solana have vibrant and active communities contributing to their growth and development. They organise events, hackathons, and initiatives to engage developers, enthusiasts, and stakeholders.

Focus on Real-World Applications: Polkadot and Solana are not limited to theoretical concepts; they emphasise real-world applications and use cases. They provide platforms for developers to build decentralised applications (dApps) that cater to various industries, including finance, gaming, and more.

| Aspect | Polkadot | Solana |

|---|---|---|

| Scalability | Utilises a multi-chain framework | Implements parallel processing for speed |

| Economic Efficiency | The shared security model lowers costs | Low transaction fees and energy efficiency |

| Community | Active community engagement | Vibrant community-driven development |

| Real-World Use Cases | Focuses on practical applications | Supports diverse, decentralised applications |

Key Differences Between Polkadot and Solana

Polkadot and Solana are prominent blockchain projects that have gained recognition for their innovative approaches and unique features. While they share similarities, they exhibit distinct differences in design, consensus mechanisms, and focus. Understanding these differences can provide insights into their respective strengths and use cases:

Distinguishing Characteristics

Consensus Mechanisms: Polkadot utilises a relay chain and para chains structure. The relay chain handles core consensus and security functions, while para chains are specialised blockchains connected to the relay chain. This design enables parallel processing and optimised scalability.

On the other hand, Solana employs a unique consensus mechanism called Proof-of-History (PoH) in combination with Proof-of-Stake (PoS). PoH acts as a verifiable timestamp for transactions, enhancing speed and efficiency, while PoS contributes to network security.

Scalability Approach: Polkadot’s heterogeneous multi-chain architecture allows it to connect and interact with various blockchains, each optimised for specific use cases. This enables customization and scalability while maintaining interoperability.

Solana focuses on horizontal scalability through its unique approach to parallel processing. Its network is designed to handle high throughput and low latency, making it suitable for applications with demanding performance requirements.

Interoperability Emphasis: Interoperability is a central focus for Polkadot, aiming to create a network of interoperable blockchains. Parachains can communicate and share data, enhancing collaboration among different projects.

While Solana also supports interoperability, its primary emphasis is high-speed transaction processing and efficient performance. It provides a platform for decentralised applications focusing on real-time use cases.

Consensus Performance: Polkadot’s consensus mechanisms prioritise security and network coordination. Its relay chain ensures the network’s integrity, and parachains contribute to specific functionalities.

On the contrary, Solana’s PoH contributes to transaction speed and order, making it particularly efficient for applications requiring rapid confirmation and low latency.

| Aspect | Polkadot | Solana |

|---|---|---|

| Consensus Mechanisms | Relay chain and parachains structure | PoH combined with PoS for efficiency |

| Scalability Approach | Heterogeneous multi-chain architecture | Parallel processing for horizontal scalability |

| Interoperability | Facilitates collaboration among parachains | Prioritises high-speed transaction processing |

| Consensus Performance | Focuses on network integrity, and coordination | Emphasises low latency and rapid confirmation |

DOT vs. SOL: A Comparison Between the Two Cryptocurrencies

Polkadot and Solana are influential cryptocurrencies, each associated with its respective blockchain platform. While both aim to revolutionise the blockchain landscape, they have distinct characteristics:

Polkadot (DOT)

- Blockchain Structure: Polkadot is built on a unique parachain structure, allowing multiple specialised blockchains (parachains) to connect to a central relay chain. This architecture enhances scalability and interoperability.

- Token Supply: Polkadot’s total supply is capped at 1 billion DOT tokens, combining newly minted tokens and bonding rewards for validators.

- Tokenomics: DOT tokens have multiple use cases, including governance, staking, bonding parachain slots, and paying transaction fees.

- Functionalities: Beyond basic transactions, Polkadot enables cross-chain communication, facilitating interaction between blockchains and transferring various data types.

Solana (SOL)

- Blockchain Structure: Solana employs a high-performance blockchain with a unique combination of Proof-of-History (PoH) and Proof-of-Stake (PoS) mechanisms. This structure contributes to its rapid transaction speeds and scalability.

- Token Supply: Solana’s maximum supply is 489 million SOL tokens, with a fixed issuance schedule. Staking rewards and transaction fees play a role in token distribution.

- Tokenomics: SOL tokens find utility in covering transaction fees, securing the network through staking, and contributing to governance decisions.

- Functionalities: Solana is known for its real-time capabilities, making it suitable for decentralised applications (dApps) requiring speed and efficiency, such as gaming, NFTs, and DeFi.

Functionalities of the Coins

Beyond basic transaction functions, DOT’s main functionality is governance and network security. Token holders can suggest and vote on network enhancements, actively contributing to the decentralised decision-making process.

On the flip side, SOL’s primary functionality centres around powering the Solana blockchain, processing transactions, securing the network through staking, and participating in the platform’s governance.

Price Movement Comparison: DOT vs. SOL

When comparing the price movement and performance of Polkadot (DOT) and Solana (SOL), it’s essential to assess their recent market trends. Here’s a breakdown of their key price indicators:

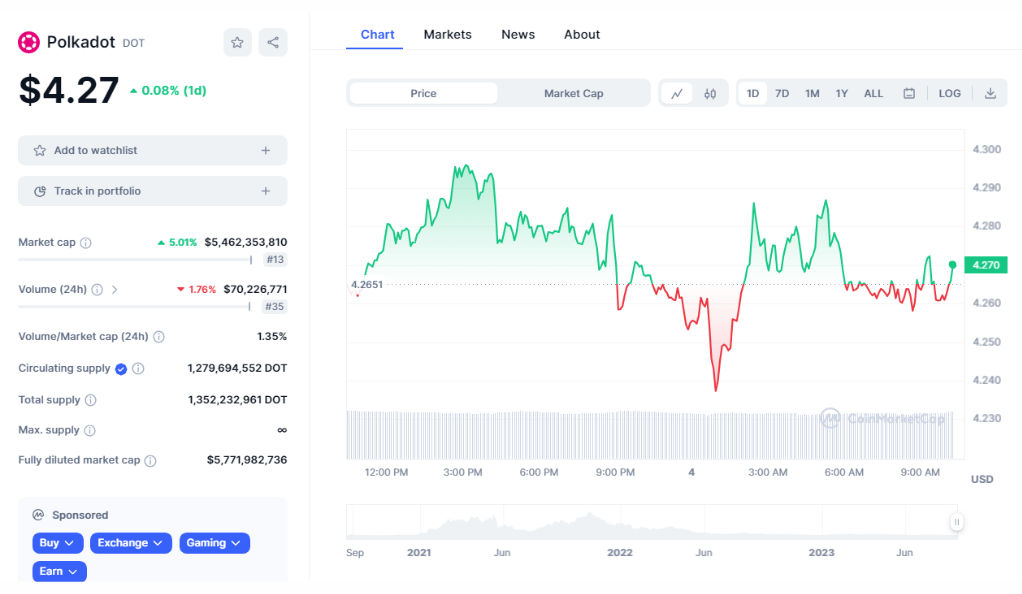

Polkadot (DOT)

Polkadot’s ranking on CoinMarketCap stands at 14, with a circulating supply of 1,262,513,441 DOT tokens. The 24-hour trading volume for DOT amounts to $67.51 million. Over the last hour, the price has seen a modest increase of +0.23%; over the past 24 hours, it has shown a slightly larger growth of +0.72%. However, over the past week, DOT’s price has experienced a decline of -0.7%.

Solana (SOL)

Solana holds the 9th position on CoinMarketCap, boasting a circulating supply of 405,972,145.514 SOL tokens. The 24-hour trading volume for SOL is substantially higher at $293.34 million. SOL’s price has risen by +0.79% in the most recent hour. Over the preceding 24 hours, it has encountered a minor decrease of -0.43%. SOL’s price has grown over the past week, with a positive change of +1.5%.

Analysing these figures underscores the inherent dynamism and volatility that characterise the cryptocurrency market. While Polkadot (DOT) and Solana (SOL) exhibit some resemblances in their price movement trends, a comprehensive understanding of their performance across diverse timeframes and market conditions is essential to making well-informed investment choices.

Factors such as circulating supply, market ranking, recent price fluctuations, and trading volume variations all contribute to the intricate interplay of supply, demand, and investor sentiment that drive the value of these cryptocurrencies.

How to Choose the Right Crypto Project to Invest in?

Always do your due diligence before investing in any project. This means thoroughly researching the project’s fundamentals, including its technology, use case, team, and partnerships. A solid foundation increases the likelihood of sustained growth and adoption.

Another key factor to consider is the project’s tokenomics. This includes studying the token distribution, supply, and utility within the project’s ecosystem. SOL’s tokenomics involves transaction fees, staking, and governance, with a fixed supply of 489 million tokens. DOT’s tokenomics includes governance, staking, and parachain bonding, with a total supply of 1 billion tokens.

As the market now is bearish, that is worth considering the projects through perspective. It’s also essential to monitor the current market sentiment surrounding the project. It’s helpful to compare the project to its competitors and evaluate its unique features, advantages, and potential challenges within its market niche.

Solana (SOL) Perspective:

Leading investors are drawn to Solana for its remarkable transaction speed and efficient scalability. The project’s strong market adoption and top cryptocurrency ranking reflect investor confidence in its potential.

Polkadot (DOT) Perspective:

Polkadot’s unique parachain structure and focus on interoperability have captured the attention of investors. The decentralised governance model, where token holders actively participate in decision-making, appeals to those valuing community involvement.

And finally, don’t forget about diversification. Avoid putting all your funds into a single project. Diversifying across different projects mitigates risk and increases the potential for returns.

Conclusion

Polkadot (DOT) and Solana (SOL) exhibit distinct differences in their design and focus. Polkadot employs a relay chain and parachains structure for scalability and interoperability, while Solana uses Proof-of-History (PoH) and Proof-of-Stake (PoS) for rapid transactions.

Polkadot emphasises collaboration among parachains, while Solana prioritises high-speed transaction processing.

Both coins have unique tokenomics and functionalities, with DOT focused on governance and security and SOL powering the Solana blockchain and participating in its governance.

Recent market trends show both coins have circulated supplies and rank 14th and 9th on CoinMarketCap, respectively. SOL has higher trading volume and slight price fluctuations compared to DOT.

FAQ

How do the consensus mechanisms of Polkadot and Solana differ?

Polkadot employs a relay chain and parachains structure, where the relay chain handles core consensus and security functions, while specialised parachains contribute to specific functionalities. Solana uses a unique combination of Proof-of-History (PoH) and Proof-of-Stake (PoS). PoH provides verifiable timestamps for transactions, enhancing speed, while PoS ensures network security.

What advantages do Polkadot and Solana offer in terms of scalability compared to traditional blockchains?

Polkadot’s heterogeneous multi-chain architecture enables customization and scalability by connecting various blockchains optimised for specific use cases. This maintains interoperability. Solana’s parallel processing and PoH mechanism achieve high throughput and low latency, making it suitable for real-time applications. Both approaches surpass traditional blockchains in transaction speed and network efficiency.

What sets Polkadot and Solana apart in the blockchain space?

Through its multi-chain architecture, Polkadot revolutionises interoperability by enabling cross-blockchain data and asset compatibility. It emphasises sustainable governance, customization, and security. Solana stands out with its unparalleled transaction speed, low fees, and unique PoH mechanism. It focuses on real-time use cases like gaming and DeFi. Both projects address scalability, but Polkadot emphasises collaboration among parachains, while Solana prioritises rapid transaction processing.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.