How to calculate tax on KuCoin?

Crypto tax calculators have made it easy for individuals to get data from KuCoin to evaluate their KuCoin tax. Whether as an individual or business, trading your crypto on KuCoin makes you susceptible to income or profit tax. You should be able to determine when you make capital gains during crypto transfers to fiat or crypto; it doesn’t matter if you are in charge of the funds or not. Check out how you can import your data for tax estimation on a crypto tax calculator.

How do I import data from KuCoin to my crypto tax calculator?

Since some crypto tax calculators support CSV file upload, follow these steps to import your data.

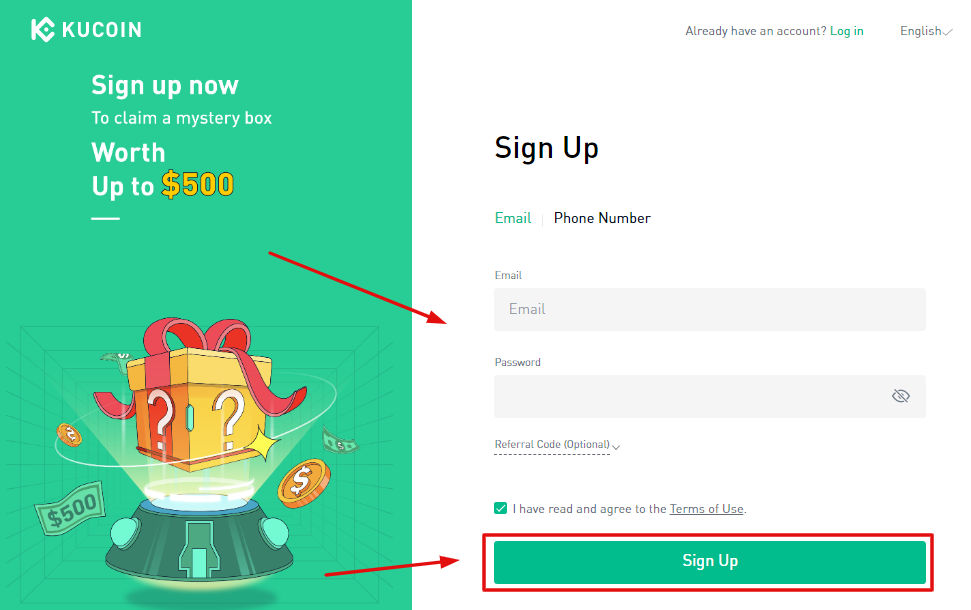

- Create an account on KuCoin: If you don’t already have an account with KuCoin, you will need to create one. To do this, go to the KuCoin website and click on the “Sign Up” button. Follow the prompts to create your account, including verifying your email address and setting up two-factor authentication (2FA) for added security.

- Log in to your KuCoin account: Once you have created your account, log in to your KuCoin account using your username and password. If you have set up 2FA, you will need to enter your 2FA code as well.

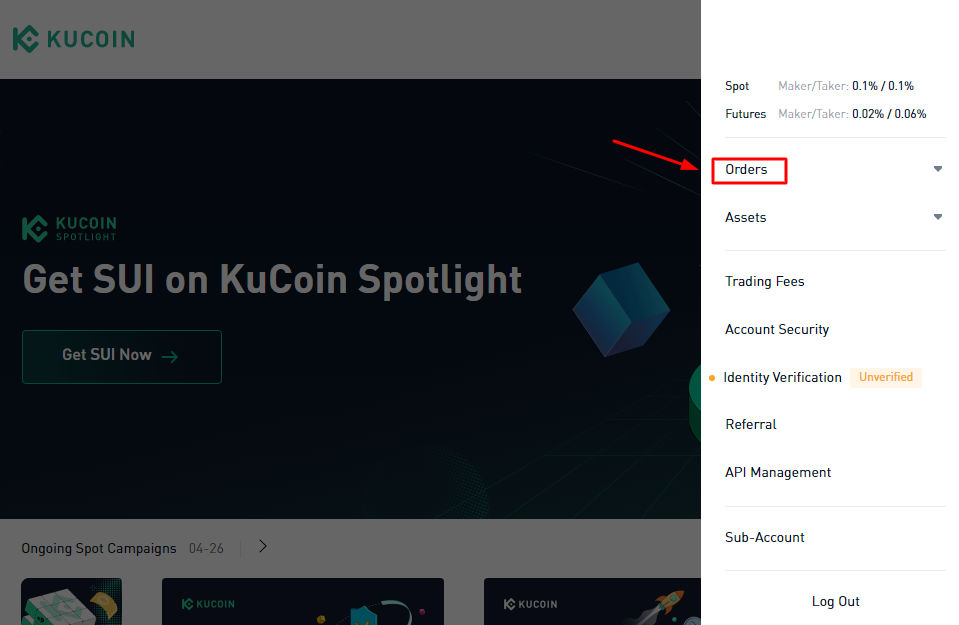

- Navigate to the “Orders” section: Once you are logged in, navigate to the “Orders” section of the KuCoin app. You can find this by clicking on the “Orders” button in the main menu.

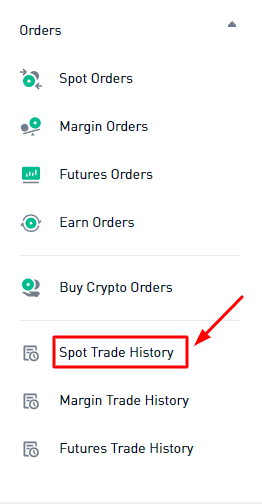

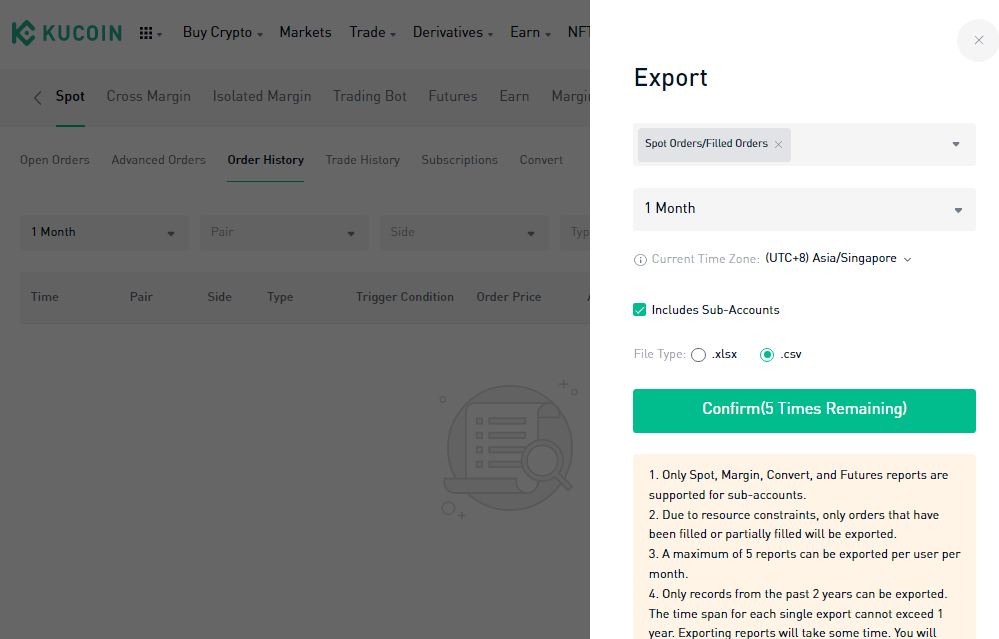

- View your spot trade history: In the “Orders” section, you will see a list of all your spot trades on KuCoin. To view your transaction history, click on the icon that shows your history on spot trade. This will display a list of all your spot trades.

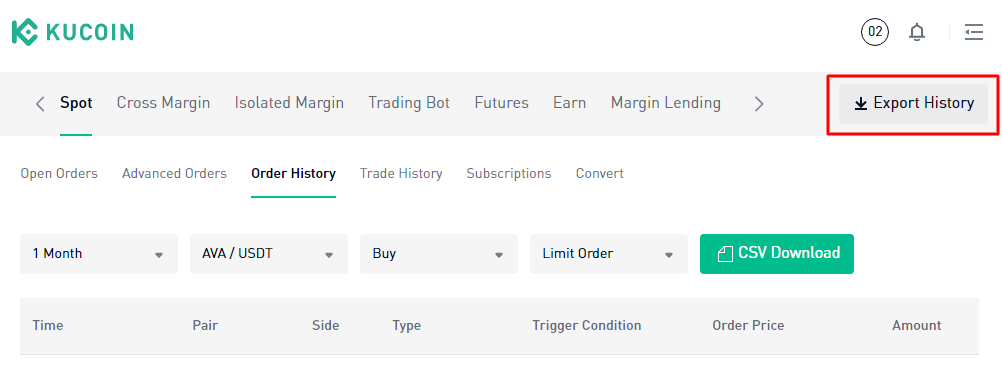

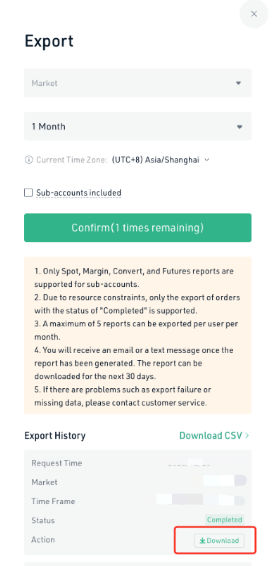

- Export your transaction history: To export your transaction history, click on the icon with “Export to CSV” on the screen. This will download a CSV file containing your transaction history for the past 100 days. If you need to access transaction history from more than 100 days ago, you will need to repeat this process for each 100-day period.

- Download the CSV file: Once the CSV file has downloaded, go to the “Downloads” folder on your computer and find the file. Double-click on the file to open it in your preferred spreadsheet program (such as Microsoft Excel or Google Sheets).

- Review your transaction history: The CSV file will contain detailed information about each of your spot trades, including the date, time, price, and quantity of each trade. Review the information to ensure that it is accurate and complete.

- Save a copy of your transaction history: Once you have reviewed your transaction history and confirmed that it is accurate, save a copy of the CSV file to your computer for future reference. This will ensure that you have a record of all your spot trades on KuCoin, which can be useful for tax purposes or for tracking your investments over time.

KuCoin Fees

KuCoin uses a tier levelling system to determine fees to be paid by traders. Higher tier traders pay lower fees; your tier is determined by your trading volume in the past 30 days. As a KuCoin trader, if you are looking to reduce your spot and futures trading fees, increase your trading volume.

Withdrawal and deposit fees

| Coin | Withdrawal fee | Deposit fee |

| Internet Computer (ICP) | $0.0027119 | No deposit fee |

| Binance USD (BUSD) | $0.9997226 | No deposit fee |

| Uniswap (UNI) | $0.1085865 | No deposit fee |

| Chainlink (LINK) | $0.1415922 | No deposit fee |

| Polygon (MATIC) | $0.2007332 | No deposit fee |

| Stellar (XLM) | $0.0018915 | No deposit fee |

| Tron (TRX) | $0.0666783 | No deposit fee |

| Bitcoin (BTC) | $0.5516762 | No deposit fee |

| Ethereum (ETH) | $0.0018619 | No deposit fee |

| USD Tether (USDT) | $0.1000031 | No deposit fee |

| Solana (SOL) | $0.2148061 | No deposit fee |

| Avalanche (AVAX) | $0.1686797 | No deposit fee |

| Dogecoin (DOGE) | $1.5764735 | No deposit fee |

| USD Coin (USDC) | $0.1000042 | No deposit fee |

| Palkadolt (DOT) | $0.5918553 | No deposit fee |

| Ripple (XRP) | $0.2325020 | No deposit fee |

| Binance Coin (BNB) | $1.6530982 | No deposit fee |

| Shiba Inu (SHIB) | $0.2067247 | No deposit fee |

| Litecoin (LTC) | $0.0869028 | No deposit fee |

How does KuCoin tax work?

When dealing with taxes on KuCoin, there are designated laws for every country. This makes it important to double check the tax laws in your region. Taxes on KuCoin transactions are very similar to taxes on every other type of crypto transaction. Whenever traders trade on KuCoin, they may be expected to pay capital gains tax (CGT). CGT will be deducted from the difference in value between the price you sold a crypto asset for and the price it was sold for.

Traders who hold crypto assets for more than a year are likely going to pay a higher rate compared to traders who hold crypto assets for less than a year. In other words, the rate on short tax capital gains is higher than that on long term capital gains.

It is essential to keep proper records of all transactions on KuCoin to be better prepared for tax assessments. KuCoin allows users to download their transaction history; this data will contain the price, time, and date of every transaction.

It is important to consult with a tax professional for further questions or advise on crypto taxes.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.