Few topics in global finance have attracted as much attention as cryptocurrencies. However, the question on everyone’s mind is whether cryptocurrencies are experiencing their decline or if they have the potential to make a comeback.

In 2009, the introduction of cryptocurrencies changed the market with the mysterious emergence of Bitcoin. This modern virtual currency market changed the financial panorama with its promise of decentralized control and seamless cross-border transactions. Its arrival ushered in a new generation of finance and captivated a wide range of audiences, from avid followers to cautious skeptics.

In this article we delve into the ups and downs of this revolution, examine the reasons behind its emergence, and ponder what lies ahead in the future.

Genesis of Cryptocurrency: A Revolutionary Spark

The rise of cryptocurrency can be traced to a seminal event sparked by a figure named Satoshi Nakamoto. In 2009, Nakamoto delivered Bitcoin, a form of currency that would revolutionize the world of finance and the future eras to come. This full-scale game-changer marked the beginning of a journey that could redefine how we know and use money.

Satoshi Nakamoto’s Vision

Satoshi Nakamoto’s groundbreaking whitepaper “Bitcoin; A Peer to Peer Electronic Cash System” pioneered this revolution. In it, he introduced the idea of a currency that could be exchanged directly between people without the involvement of banks or other intermediaries. Nakamoto’s ingenious concept was based on technology that was a transparent and tamper-proof distributed ledger for authenticating and recording transactions.

The breakthrough aspect of Nakamoto’s creation was decentralization. Unlike traditional currencies, which are controlled by central banks, Bitcoin was designed to function autonomously, with its issuance and transaction verification managed by a network of participants. This shift in control challenged established financial norms and offered individuals a new level of financial sovereignty.

Additionally, Bitcoin’s debut was timely, occurring in the wake of the 2008 global economic crisis. As traditional economic structures faltered, Nakamoto’s proposal for a currency that was beyond the influence of governments and economic institutions resonated with those seeking alternatives. The appeal of a borderless, censorship-resistant foreign currency was further strengthened by the distrust many felt toward traditional financial institutions.

The Ripple Effect: Altcoins and Innovation

The idea of Bitcoin had an impact on the development of many other cryptocurrencies commonly referred to as “altcoins.” This major boom confirmed the blockchain era’s ability to go beyond currency packages. Developers and entrepreneurs began exploring the use of contracts and decentralized programs, all based on Nakamoto’s fundamental principles.

Thus, the introduction of cryptocurrencies was no longer about introducing a form of cash, but a technological revolution that could have far-reaching effects on all industries and economies worldwide. Satoshi Nakamoto’s groundbreaking concept lit a flame that continues to glow today, illuminating both the opportunities and challenges that are emerging in the field of currencies.

Cryptocurrency’s Golden Era: A Meteoric Rise

Bitcoin’s journey began with small beginnings and its value was measured only in cents. However, its potential to transform financial transactions quickly caught the attention of technology enthusiasts and early adopters. This act turned into an event and caused the bitcoin price to skyrocket. In 2013, it crossed the $1,000 mark, which was a historic milestone and marked the beginning of a new era.

A Catalyst for Innovation

However, the meteoric rise of cryptocurrencies was rooted far deeper than a simple Bitcoin’s price surge, as the era of the cryptocurrencies served as a catalyst for technological innovation.

More specifically, the influx of investments and enthusiasts prompted developers to look for new methods to use blockchain to offer services and create business. During this period, Initial Coin Services (ICOs) have gained traction as a way to crowdfund projects, and blockchain solutions are beginning to find applications in areas beyond finance, which include supply chain control, healthcare and identity verification

A new financial frontier

Thanks to all the investments and interest in the cryptos and their derivatives, these new currencies have started to be considered as potential tradable assets. Therefore, cryptocurrencies became more and more popular, especially among exchanges, as traders were lured in by potential, but significant, capital gains.

However, even though the Golden Age was characterized by a rapid rise and innovation, challenges and uncertainties also emerged as the cryptocurrency ecosystem struggled with issues such as law, security, and market volatility.

Challenges that Chipped Away: Hurdles in Cryptocurrency Adoption

While the rise of cryptocurrency during the golden age was marked by excitement and power, its widespread acceptance also presented challenges, such as environmental problems, which delayed the path towards mainstream integration and forced the industry to deal with these critical issues.

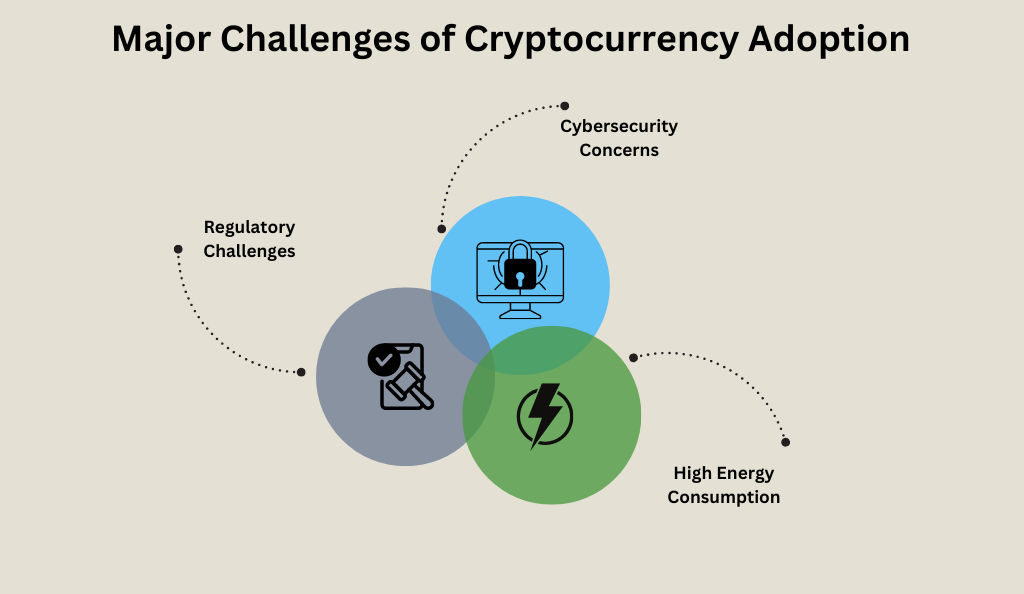

Regulatory Challenges: The Clash of Traditional and Digital

One of the main challenges that cryptocurrency faced was navigating the complexities of global regulations. Traditional financial systems are largely regulated by governments and central banks, so the decentralization of cryptocurrency left regulators in shock and the absence of rule.

This aspect quickly gave rise to significant concerns including abuse, tax evasion, money laundering and other illegal activities.

Cybersecurity Concerns: Balancing Access and Protection

In addition, the emergence of cryptocurrency exchanges and virtual wallets has opened up new avenues for monetary transactions, but has also exposed many vulnerabilities in this environment.

High-profile hacks and security breaches have led to the loss of billions of dollars worth of digital assets. It quickly became a challenge to balance easy customer access to their money with robust security features.

Excessive Energy Consumption: The Ecological Footprint of Cryptocurrency

As cryptocurrency mining grew in reputation, so did concerns about its environmental impact. The electricity-intensive mining process, especially for cryptocurrencies that claim to be paintings like Bitcoin, raised alarms about the cryptocurrencies’ carbon footprint.

Many critics over the years sustained that the energy input needed to run a mining operation reached unsustainable levels and that it will contribute to climate change. This has led to a debate in the industry about exploring environmentally friendly alternatives and innovating the current technologies to ensure a lower carbon footprint.

Seeking Solutions Amidst Challenges

Despite these challenges, the cryptocurrency community has demonstrated its resilience by actively seeking solutions to overcome these obstacles.

Legal measures were initiated to foster a more transparent and accountable ecosystem, while providing increased security features to protect the assets of users. Besides, the industry demanded strategies to reduce the environmental impacts of mining by adopting energy efficient technologies and advocating sustainable practices.

These challenges highlighted the need for collaboration between stakeholders, including governments, industry players and the broader public.

The Current Landscape: Is Cryptocurrency still a valuable investment?

After the initial challenges and hurdles that threatened to put a stop to this digital revolution had been solved, cryptocurrencies had room to run. As a matter of fact, in our current landscape digital currencies are not only talked about by traders and investors, but also by banks and institutions as a way to build a stronger backbone for all of their services.

Institutional Embrace: A Starring Role for Cryptocurrency

One of the most significant changes in recent times has been the increasing adoption of cryptocurrency by institutional players. Big corporations, financial institutions and even governments are starting to realize the possibilities. Tesla’s massive investment in bitcoin and PayPal’s integration of cryptocurrency for payments made the industry feel legitimate and fresh. These endorsements signal a shift, where cryptocurrency turns from niche interest to headline discussion in corporate boardrooms and budget meetings.

Decentralized Finance (DeFi): A Paradigm Shift in Banking

The rise of decentralized finance (DeFi) has caused widespread modifications in conventional banking practices. DeFi structures use blockchain generation to offer services which include lending, borrowing, and trading, all without intermediaries. This disruption can reshape financial services via offers to get admission to savings for underserved populations and a greater inclusive global financial system The DeFi motion is the capacity of blockchain to venture established norms and open up the economic system of the opportunities.

NFT Revolution: Redefining Ownership in the Digital Age

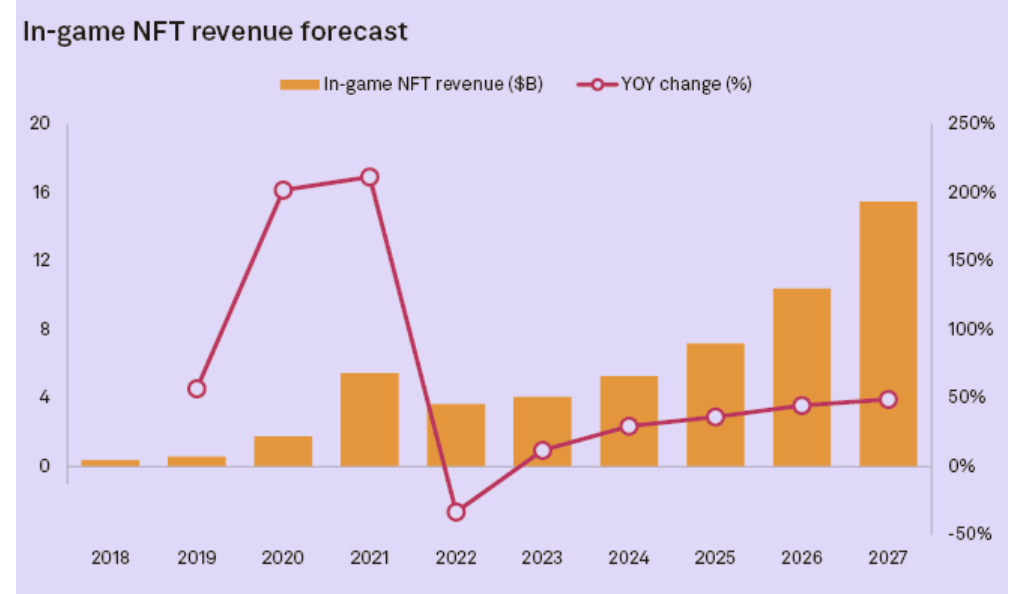

Non-fungible tokens (NFTs) have taken the sector by surprise, grabbing headlines and sparking discussions. NFT represents ownership of particular digital property, from digital artwork to collectibles. This phenomenon has reimagined the connection between artists and audiences and opened doors to monetize their paintings immediately.

However, questions continue to be about the sustainability and sturdiness of this fashion, some investors see NFTs as the destiny of virtual possession. Additionally, today the NFTs’ market is at its strongest point ever with many projects and collectibles being released every year.

Looking Forward: Prospects and Potholes

Despite the fact that many people as soon as cryptocurrencies faced the first significant challenges would have quickly answered that it was just a “hype train” and nothing more, to really understand if this new digital era has potential and represents an investment opportunity, it is also important to look at the future.

Bridging the Gap: Cryptocurrency and Traditional Finance

One of the main promises that keeps the value of cryptocurrencies high, is their integration into traditional economic systems. Efficient blockchain-based transactions have the capability to transform payments across borders, lessen charges and decrease processing times, creating a widespread benefit for the society.

However, this integration brings a lot of challenges. Aside from harmonized rules, standardization of protocols, international laws, cybersecurity issues and more, one of the most crucial steps towards the success of cryptocurrencies is bridging the gap between the people and this new technology.

For such a mass implementation of cryptocurrencies to work, everyone should be familiar with the technology and processes used. Even though it is likely that overtime this will happen, it might certainly pose significant barriers in the near future.

Financial Inclusion: Cryptocurrency’s Potential Social Impact

Another extremely important aspect that cryptocurrencies should be evaluated for, is their ability to promote financial inclusion and equal access to the financial markets. Because cryptocurrencies are not strictly regulated by any authority, trading such assets incurs very low fees, allowing brokers to offer very cheap trading services.

Additionally, all the decentralized financial networks that are forming thanks to the cryptocurrency revolutions do not undergo all the physical constraints that our current brick and mortar banks are subject to. Because of this, in the future it might also become much cheaper and easier to have a bank account, or wallet, thanks to this new technology.

Navigating the Potholes

Although the outlook is encouraging, it is undeniable that some potholes have formed on the road to the success of cryptocurrencies.

First of all, regulatory uncertainty remains a challenge as governments struggle to find a balance between innovation and environmental protection. Secondly, market volatility continues to test investors’ nerves and requires a deeper understanding of risk management strategies to avoid significant losses in the crypto market.. Additionally, smart contracts require constant vigilance around security concerns, including potential vulnerabilities and digital asset protection.

Conclusion

In an ever-changing economic landscape, the question “Is cryptocurrency dead?” leads to a complex response. Our research has revealed a history of resilience, innovation, and challenge.

While it is undeniable that cryptocurrencies have encountered significant roadblocks, their faith is not yet sealed. After an initial boom in popularity thanks to the innovative decentralized finance proposed by Bitcoin during the 2009 distrust of institutional authorities, this digital revolution almost came to a stop due to the increasing evidence against it, including illegal activities and a negative climate impact.

However, our research shows that over the years not only cryptocurrencies managed to solve most of these problems, but also found many other ways in which they could be implemented to improve the quality of life of many people.

For example, NFTs, Web3 and the metaverse are all exciting projects and investment opportunities based on the initial concepts laid down by Satoshi Nakamoto in 2009.

All in all, despite having encountered some difficulties, we certainly cannot state that cryptocurrencies are dead. Excitement, opportunities and investments are just around the corner, so let’s sit back and enjoy what this digital revolution has to offer!

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.