How to calculate tax on AltCoinTrader

Crypto tax calculators allow users to upload data directly from AltCoinTrader, allowing for easy calculation of AltCoinTrader taxes. AltCoinTrader has a CSV history download feature that enables users to manually import their transaction history files into a crypto tax calculator. This functionality allows for a more streamlined and precise calculation of cryptocurrency trades and transactions, making it simpler for users to track their tax obligations.

How do I use CSV to import AltCoinTrader data?

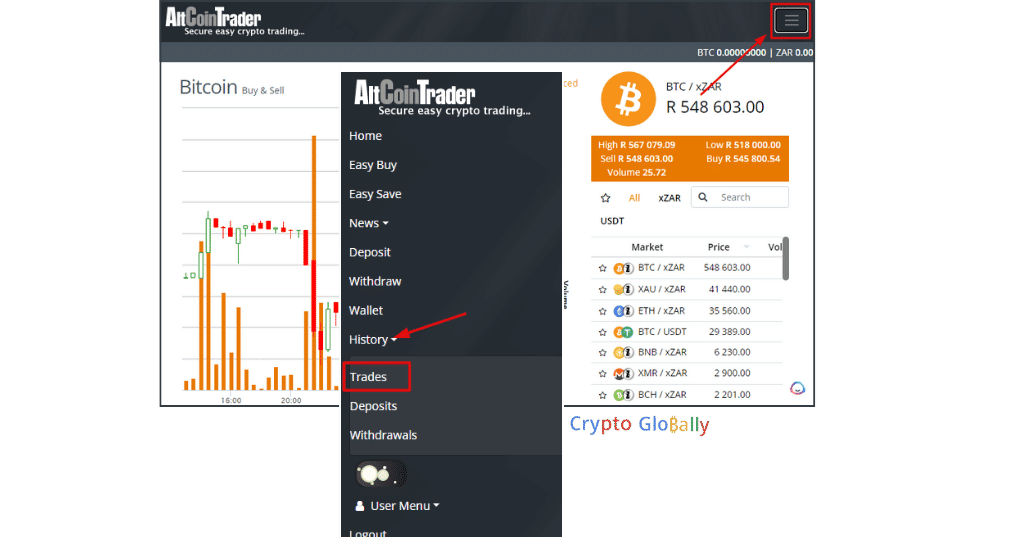

- Sign in to your AltCoinTrader account.

- Click on history which can be found at the top of your home screen, and select trades

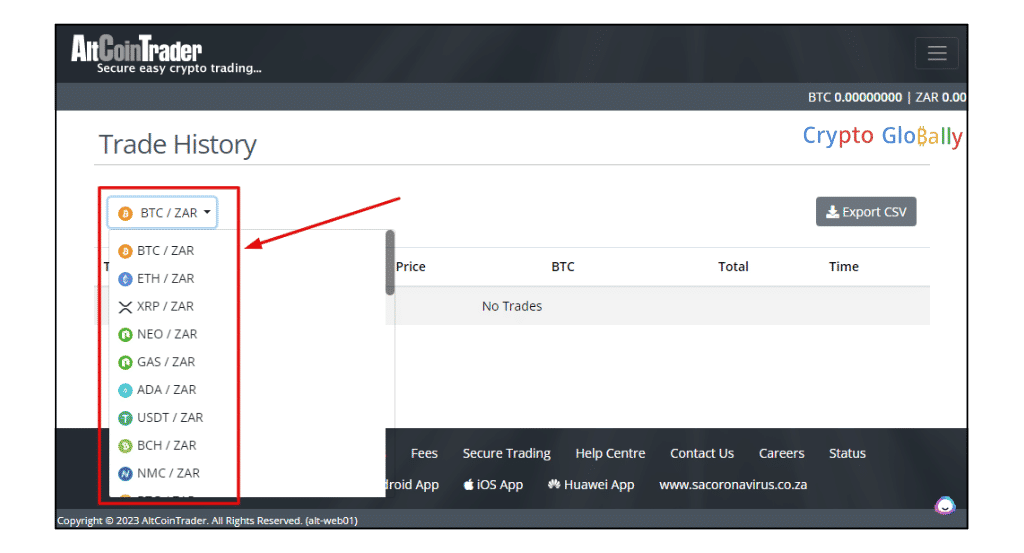

- After selecting trades, there will be a history menu option by the left side of your screen. You will be required to choose the crypto pair history you would like to download.

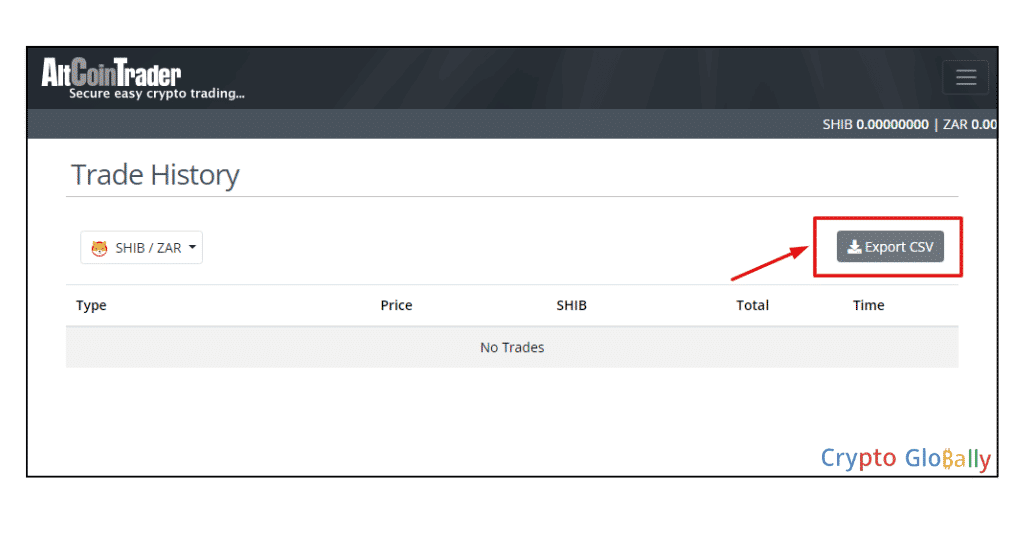

- Click the ‘Export CSV’ which is found in the upper right corner of the your screen, this will allow you download your CSV files.

AltCoinTrader Fees

AltCoinTrader charges 0.75% buying and selling fees and 0.01% trading fees.

Deposit and Withdrawal fees

| Currency Name | Withdrawal fee | Deposit Fee |

| Bitcoin (BTC) | 0.00015792 BTC | No deposit Fee |

| Ethereum (ETH) | BSC – 0.000110652 ETH ERC20 – 0.0090825 MATIC – 0.00054815 | No deposit fee |

| Solana (SOL) | 0.015 SOL | No deposit fee |

| USD Tether (USDT) | BSC – 2.63884803 USDT ERC20 – 25.36166875 USDT | No deposit fee |

| South African Rand (ZAR) | R16 and 0.5% max of R95 | 0.5% max of R95EFT and cash deposit fees are decided by banks.5% extra fee on cash deposits. Banks also determine the fees on international deposits. |

| BNB (BNB) | 0.00712600 BNB | No deposit fee |

| Cardano (ADA) | 1 ADA | No deposit fee |

| Polkadot (DOT) | 0.075 DOT | No deposit fee |

| Dogecoin (DOGE) | 8 DOGE | No deposit fee |

| Polygon (MATIC) | ERC20 – 21.50184436 MATIC BSC – 2.12956398 MATIC Polygon – 1.01463120 MATIC | No deposit fee |

| USD Coin (USDC) | ERC20 – 15.35626536 USDC BSC – 2.25 USDC Polygon – 2.25 USDC | No deposit fee |

| Litecoin (LTC) | 0.02 LTC | No deposit fee |

| LINK (LINK) | 2.444210229 LINK | No deposit fee |

| Bitcoin Cash SV | 0.01 BCHSV | No deposit fee |

| Bitcoin Gold (BTG) | 0.02 BTG | No deposit fee |

| Bitcoin Cash (BCH) | 0.005 BCH | No deposit fee |

| Ripple (XRP) | 1 XRP | No deposit fee |

| Stellar Lumens (XLM) | 2 XLM | No deposit fee |

| Tron (TRX) | 8 TRX | No deposit fee |

| SHIB (SHIB) | BSC – 463327.16134 ERC20 – 1748225.5520197 SHIB | No deposit fee |

| Namecoin (NMC) | 0.5 NMC | No deposit fee |

| Dash (DASH) | 0.01 DASH | No deposit fee |

| Monero (XMR) | 0.008 XMR | No deposit fee |

| ZCash (ZEC) | 0.01 ZEC | No deposit fee |

| NEO (NEO) | No withdrawal fee | No deposit fee |

| GAS (GAS) | No withdrawal fee | No deposit fee |

| BitTorrent (BTT) | 500000 BTT | No deposit fee |

| Krugerrand (XAU) | Dynamic fee | No deposit fee |

| Silver (XAG) | Dynamic fee | No deposit fee |

| South African Tether (XZAR) | Polygon – 20.29540398 ERC20 – 438.50179979 | No deposit fee |

| Basic Attention Token (BAT) | 47.37445571 BAT | No deposit fee |

| Compound (COMP) | 0.38471537 COMP | No deposit fee |

| DAI (DAI) | 25.97087266 DAI | No deposit fee |

| Songbird (SGB) | 4 SGB | No deposit fee |

| Ethereum POW (ETHW) | 0.115 ETHW | No deposit fee |

| Flare (FLR) | 18 FLR | No deposit fee |

How does AltCoinTrader Tax work?

Crypto exchanges are not responsible for calculating users’ taxes; users are responsible for tracking their crypto transactions and making all relevant tax self-assessment reports to the designated authority. If you trade cryptocurrencies using AltCoinTrader, you can be subject to capital gains tax (CGT). CGT is a tax levied on the profits from the sale of assets, including cryptocurrencies. The CGT rate fluctuates from 0% to 50% based on location and tax bracket.

When calculating your capital gains tax, it is important that you keep track of the date and value of your cryptocurrency transactions, as well as all the costs and fees incurred. This information will be used to calculate the loss or profit from each transaction and the amount to be paid as CGT.

It’s essential to keep in mind that losses incurred from crypto trading can be deducted from future earnings, thus lowering possible tax obligations. If you have further tax-related questions, kindly consult a tax professional.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.