How to calculate tax on crypto.com?

As part of the process of getting your crypto.com tax, your transactions data have to be uploaded to a crypto tax calculator. Crypto.com has provided two methods to make this happen. The first is via an API and the second is a CSV history. Both methods work efficiently in calculating your taxes.

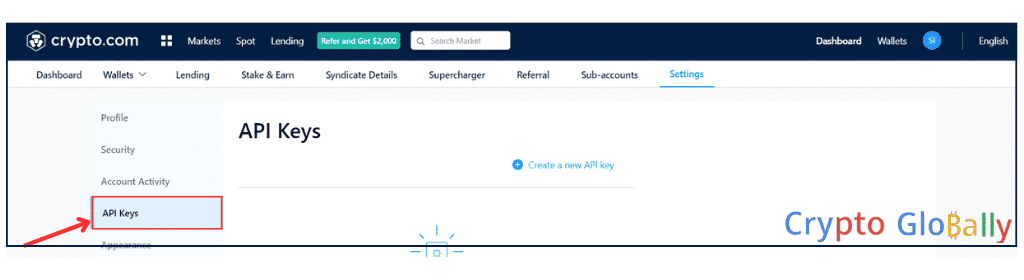

How to create and use API keys on crypto.com?

This is the simplest method of importing data because you just have to create an API and send the information with the crypto tax calculator. Follow these steps:

- Access your Crypto.com account by logging in.

- Locate the avatar icon situated in the top right corner and click on it.

- Under ‘API Setting’, find and click on the ‘New API key’ option.

- Input the required Two-Factor Authentication (2FA) code for verification.

- Ensure that the ‘View’ permission checkbox for the API key is ticked.

- Click on ‘Generate API key’ to create your new API key.

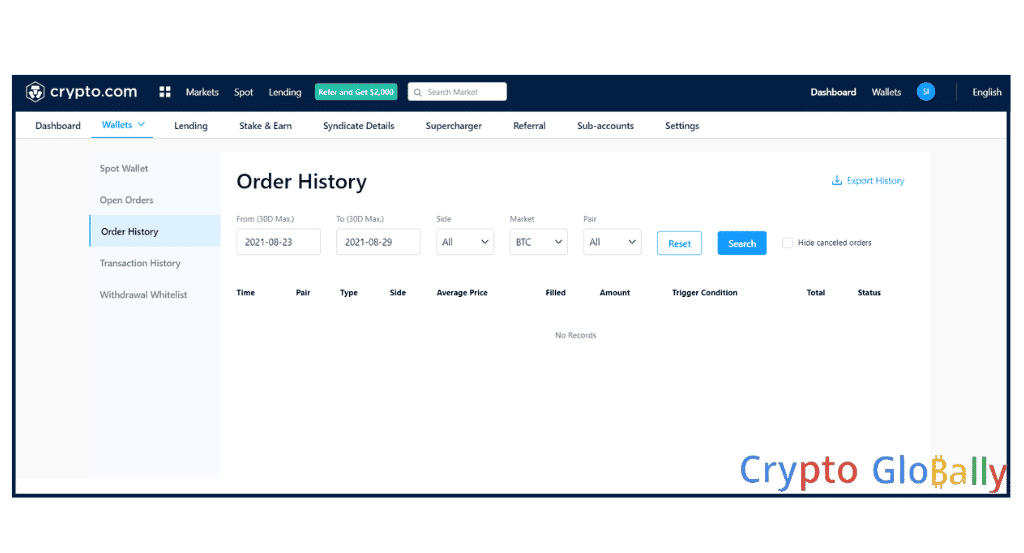

How to get your CSV data on crypto.com?

The CSV is a substitute for API. You need to download the data of your transaction from Crypto.com and upload the files to a crypto tax calculator. Follow these steps:

- Go to Crypto.com and find your way to the Accounts tab.

- To get your transaction history, click on the icon which is located in the app’s top-right area.

- Use the ‘Export” icon which is also at the top-right area to export your transaction to the crypto tax calculator.

- Pick a kick-off date for all transactions and a finish date which is the present day.

Crypto.com fees

Crypto.com employs a VIP tier system to determine the fees for spot, margin, and futures trading. The level of the trader’s VIP tier corresponds to the fees they will pay, with higher tiers receiving lower fees.

To move up the VIP tier, a trader must increase their trading volume within a 30-day period. As the trading volume increases, the VIP tier level increases, which results in lower fees. This incentivizes traders to increase their trading activity and provides an opportunity to save on trading fees.

Withdrawal and deposit fees

| Coin | Network | Withdrawal fee | Deposit fee |

| 1INCH | ERC20 – Cronos | 7 – 0.2 INCH | No fee |

| ADA | ADA – Cronos | 0.5 – 0.18 | No fee |

| AAVE | ERC20 – Cronos | 0.15 – 0.002 | No fee |

| ATOM | Cosmos – Cronos | 0.1 – 0.02 | No fee |

| AVAX | AVAX – Cronos | 0.005 – 0.005 | No fee |

| BCH | BCH – Cronos | 0.001 – 0.001 | No fee |

| BTC | BTC | 0.0005 BTC | No fee |

| DOGE | Cronos – DOGE | 1.4 – 6 | No fee |

| DOT | DOT | 0.1 | No fee |

| ETH | ERC20 – Cronos | 0.004 – 0.0001 | No fee |

| FIL | Cronos – FIL | 0.02 – 0.03 | No fee |

| FTM | ERC20 – FTM | 50 – 0.1 | No fee |

| HBAR | Cronos – HBAR | 1 – 0.8 | No fee |

| ICP | Cronos – ICP | 0.000025 | No fee |

| LINK | ERC20 – Cronos | 0.45 – 0.013 | No fee |

| NEAR | Cronos – NEAR | 0.02 – 0.1 | No fee |

| SHIB | ERC20 – Cronos | 600000 – 7000 | No fee |

| SOL | Cronos – SOL | 0.003 – 0.0005 | No fee |

| SUSHI | ERC20 – Cronos | 2 – 0.05 | No fee |

How does Crypto.com Tax work?

Cypto.com offers a feature called tax report where users can estimate and calculate tax commissions that are investments and crypto trading related on crypto.com. This tax report gives users a summary of their transactions on Crypto.com like cryptocurrency trading, selling and buying. It also gives the cost of every transaction and the value of the US dollar.

You have to log into your account on Crypto.com to access your report, then find your way to Finance tab and then the tax section. You can generate a report for a tax year and export it as CSV file for referencing.

The tax report you will be getting includes cryptocurrency transactions in USD, cost basis, capital losses and gains, and total capital losses and gains. Users should consult a professional in tax to be sure that they are compliant and meet their obligations to crypto tax.

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.