During times of market turbulence, stablecoins can be advantageous to own. Stablecoins are linked to an underlying asset or currency, which protects against market fluctuations and liquidity problems. Accordingly, they are optimal for managing market risks and taking advantage of opportunities in any market climate. Additionally, they are gaining popularity due to their cost-effectiveness compared to conventional financial systems.

Stablecoins are also gaining traction due to their ease of use and accessibility. They can be used by investors unfamiliar with cryptocurrencies, making them an attractive option for businesses and traders looking to diversify their portfolios. Additionally, they provide quick transactions compared to traditional banking systems, ensuring faster settlements and higher levels of liquidity.

As the stablecoin market grows and matures, more specialized offerings will likely emerge in response to customer demand, further expanding the opportunities for investors and businesses. This article will discuss the most common digital assets, USDC and USDT.

Understanding Stablecoins

Stablecoins play a significant role in the cryptocurrency market as they provide a dependable and consistent means of exchanging value. They accomplish this by linking their value to a particular asset or fiat currency, usually the US dollar, unlike other cryptocurrencies, which tend to have more unpredictable price fluctuations.

Cryptocurrencies like Bitcoin and Ethereum have benefits like decentralization and quick transactions. Still, their value can quickly rise and fall, making it difficult for users who need a stable currency or want to protect their money’s worth.

Stablecoins were created to tackle the issue of unpredictability in the digital asset market. They are digital assets with a constant value tied to a fiat currency, and they provide stability while still utilizing the advantages of blockchain technology.

There are three types of stablecoins: fiat-collateralized, cryptocurrency-collateralized, and algorithmic stablecoins. Fiat-collateralized stablecoins, such as USDT and USDC, are supported by reserves of the fiat currency they represent, usually held in bank accounts.

Cryptocurrency-collateralized stablecoins are backed by other cryptocurrencies, providing collateral that maintains the stability of the stablecoin.

Algorithmic stablecoins, on the other hand, use complex algorithms and smart contracts to adjust the supply and demand of the stablecoin to maintain price stability.

The market for stablecoins has expanded, with over 83 types currently available and a total market capitalization of $128,115,659,708. USDT is still the market leader, with a dominance of 49.0% as of the end of January 2023. USDC and BUSD have also grown, with market shares of 30.9% and 11.4%, respectively. With so many options, investors now have more flexibility and choice.

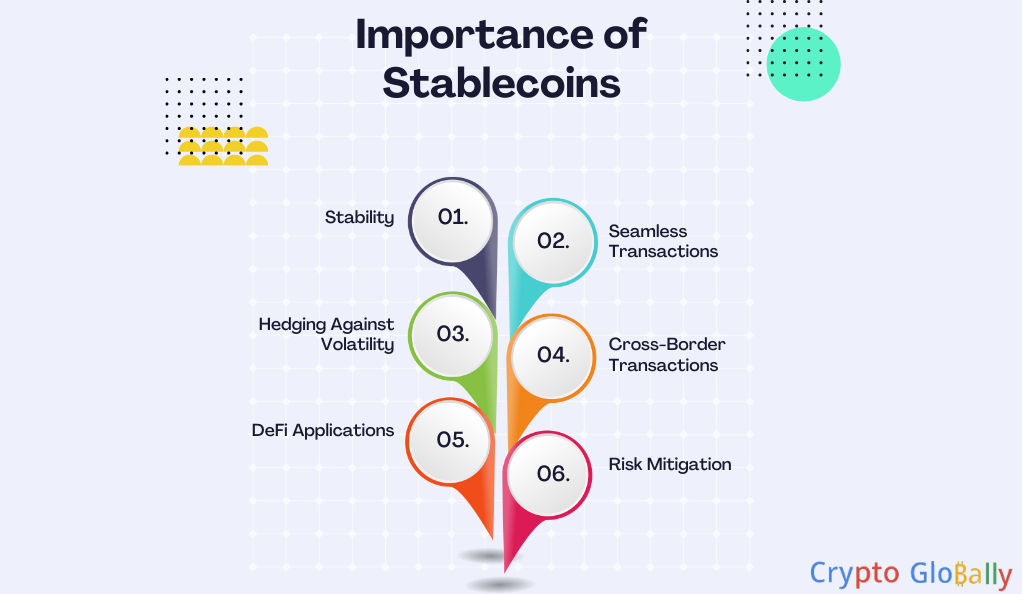

Why are Stablecoins Important

Stablecoins play a vital role in the cryptocurrency ecosystem and have garnered significant importance for various reasons:

- Stability: The primary purpose of stablecoins is to provide stability in an otherwise volatile cryptocurrency market. By pegging their value to a specific asset or fiat currency, stablecoins aim to minimize price fluctuations. This stability makes them an attractive option for users who seek a reliable store of value or a medium of exchange without being exposed to the high volatility of other cryptocurrencies.

- Seamless Transactions: Stablecoins facilitate quick and seamless transactions within the cryptocurrency ecosystem. As stablecoins are designed to maintain a stable value, they can be easily exchanged between cryptocurrencies. This feature enables users to bypass the traditional banking system and conduct transactions directly with other participants in the cryptocurrency market.

- Hedging Against Volatility: Volatility is a significant challenge cryptocurrency traders and investors face. Stablecoins offer a practical solution by providing a hedge against market volatility. When uncertain or unfavorable market conditions, users can convert their assets into stablecoins to protect their value. This allows them to temporarily store their funds in a stable form until they decide to re-enter the market.

- Cross-Border Transactions: Stablecoins have the potential to revolutionize cross-border transactions. Traditional international transfers can be slow, costly, and subject to intermediaries. With stablecoins, users can transfer value across borders quickly and at a lower cost, bypassing the traditional banking system. This feature opens up opportunities for global financial inclusion and enhances the efficiency of remittance payments.

- Decentralized Finance (DeFi) Applications: Stablecoins are widely utilized in various decentralized finance (DeFi) applications. DeFi platforms enable users to lend, borrow, and earn interest on their cryptocurrency holdings. Stablecoins serve as a stable medium of exchange within these platforms, allowing users to participate in DeFi protocols without being exposed to the volatility of other cryptocurrencies.

- Risk Mitigation: Stablecoins offer a way to mitigate risks associated with holding cryptocurrencies. As stablecoins are typically backed by reserves or collateral, users are assured that their stablecoin holdings’ value is tied to a real-world asset or currency. This backing provides a layer of risk mitigation, reducing potential losses due to price volatility.

Overview of Tether (USDT)

Tether (USDT) was introduced in 2014 by Tether Limited, a Hong Kong-based company, to bridge the gap between cryptocurrencies and traditional fiat currencies. It was the first stablecoin to offer users a platform-agnostic, blockchain-based US Dollar with the advantages of cryptocurrencies, such as high liquidity, while avoiding their volatility.

Tether provides a permissionless way to send crypto dollars quickly, transparently, and cheaply, opening up various use cases for cryptocurrencies, including remittances and payments. Upon its release, numerous cryptocurrency trading pairs listed against USDT, giving it a first-mover advantage in the stablecoin market.

Approximately 74.7 billion USDT tokens are circulating on major blockchains, including Bitcoin, Ethereum, EOS, Algorand, and Tron. USDT is the most popular trading pair in the crypto market and can be used on exchanges to buy or swap hundreds of other cryptocurrencies.

One of the critical features of USDT is its ability to facilitate cheap and fast transactions while allowing users to earn interest on decentralized finance (DeFi) protocols. It also offers merchants a way to accept cryptocurrency payments denominated in fiat without the risk of accepting more volatile cryptocurrencies.

USDT has consistently ranked among the top 5 cryptocurrencies in terms of market capitalization and trade volume, often surpassing the daily trading volume of Bitcoin. While there may be slight fluctuations in price, USDT’s value is designed to remain stable at around $1, and the market quickly corrects itself to maintain this fixed price.

Although Tether is the largest and most popular stablecoin, it has faced controversies and concerns regarding its transparency and reserve backing. Tether has yet to prove that its fiat reserves adequately support the circulating supply of USDT tokens.

Financial regulators and law enforcement have investigated Tether, revealing insufficient reserves and using corporate loans and bad debt to shore up the funds.

Tether’s sister company, Bitfinex, also used Tether’s reserves to address missing client and corporate funds without informing investors. However, Tether has made efforts to improve transparency and now provides daily updates on the state of its reserves.

The stablecoin giant has taken steps to address its murky history and is committed to increasing transparency within the ecosystem.

Overview of USD Coin (USDC)

USD Coin (USDC) is a stablecoin created by Coinbase and Circle in 2018. It operates as a crypto asset backed by fiat currency and is pegged to the value of 1 USD. Initially deployed as an ERC-20 token on the Ethereum blockchain, USDC has gained a solid reputation for transparency and reliability.

The Centre Consortium, which includes trusted financial institutions like Circle and Coinbase, governs USDC. It ensures the implementation of technical and financial standards for the stablecoin, providing transparency around its 1-to-1 backing. For every USDC token created, $1 of USD is held in reserve in US dollars and other cash equivalents.

USDC has a circulating supply of approximately 34.6 billion tokens, with an equal dollar amount held in reserve. Approved regulated financial institutions that meet Circle’s membership framework can issue USDC, contributing to the growth of the USDC ecosystem.

The stablecoin is widely available on major exchanges and cryptocurrency providers. Similar to USDT, USDC can be sent and received using any wallet or exchange that is ERC-20 compatible. Additionally, USDC is supported on various blockchains, including Algorand, Stellar, Binance Smart Chain, Hedera, Tron, Solana, and more.

Regarding market capitalization and daily trading volume, USDC often ranks within the top 10 cryptocurrencies, trailing behind USDT. The stablecoin has witnessed a rising market capitalization, reflecting its increasing popularity and adoption.

USDC maintains its stability at a value of approximately $1. While fluctuations can occur with stablecoin, these deviations are swiftly corrected, bringing the price back to the $1 peg.

Overall, USD Coin has established itself as a reliable stablecoin in the cryptocurrency market. Its transparent and regulated approach and wide availability and stability have contributed to its growing prominence as a trusted digital asset.

Comparison between USDT and USDC

USDT and USDC are two of the most prominent stablecoins in the cryptocurrency market but have notable differences.

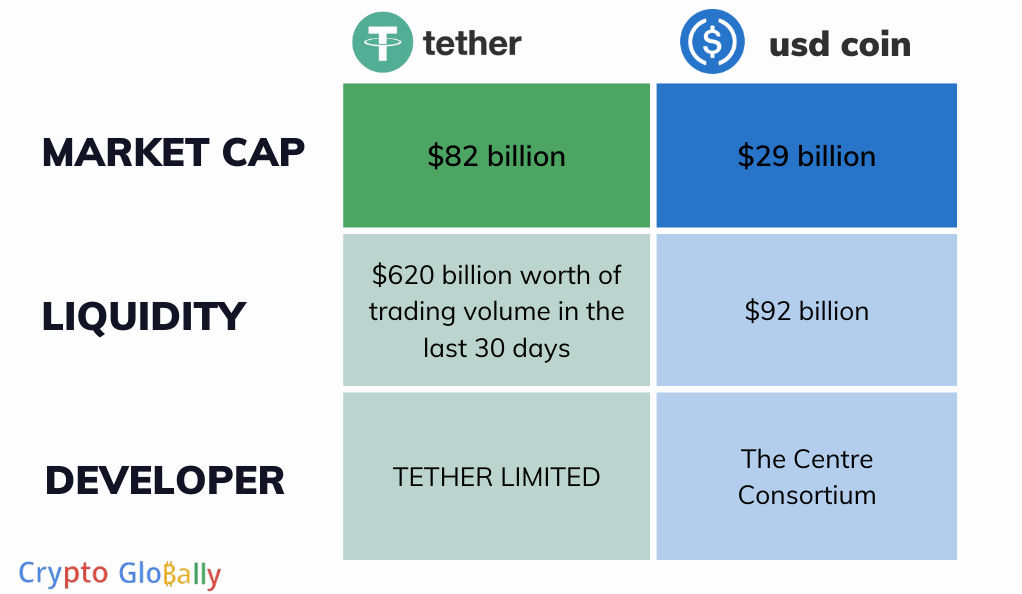

Regarding market share, Tether (USDT) has a clear lead over USD Coin (USDC). USDT boasts a market cap of $82 billion, more than double the size of USDC’s $29 billion market cap. Tether also enjoys deeper liquidity, with over $620 billion worth of trading volume in the last 30 days, compared to USDC’s $92 billion.

USDT and USDC are widely adopted and available on various blockchains, including Ethereum, BNB Chain, Tron, Solana, etc. However, USDC has an advantage in terms of adoption through its partnership with Visa. The Circle Visa Corporate card allows customers to use USDC as a payment method at over 60 million merchants worldwide. Additionally, USDC benefits from its relationship with Coinbase, as it does not list USDT on its exchange platform.

Regarding safety and transparency, USDC has positioned itself as a more accountable stablecoin. The Centre Consortium, the governing body behind USDC, regularly complies with audits and releases monthly reports on its reserves, providing greater transparency. On the other hand, Tether has faced scrutiny and has been hesitant to release complete updates on its reserve composition. While Tether has taken steps toward transparency, there are still calls for a full audit.

Ultimately, the choice between USDT and USDC depends on personal preference and specific use cases. Tether’s larger size and established presence make it a popular choice, but USDC’s transparency and resilience have gained recognition and are rapidly closing the gap. Additionally, diversifying holdings across multiple stablecoins may provide added security and flexibility.

USDT vs. USDC Use Cases

USDT and USDC, being stablecoins pegged to the value of the US dollar, serve similar use cases in the cryptocurrency ecosystem. Here are some common use cases for both stablecoins:

- Trading: USDT and USDC are widely used as trading pairs on cryptocurrency exchanges. Their stable value allows traders to hedge against market volatility by quickly converting their holdings into a stablecoin during price fluctuations. Both stablecoins provide liquidity and enable seamless trading between cryptocurrencies.

- Remittances: Stablecoins like USDT and USDC offer a faster and more cost-effective alternative for cross-border remittances than traditional banking systems. By leveraging blockchain technology, individuals can send and receive funds globally with reduced transaction fees and processing times.

- Payments: Merchants can accept payments in USDT or USDC without the risk of exposure to the volatility of other cryptocurrencies. Stablecoins provide a more stable and reliable medium of exchange for goods and services in the digital economy.

- Decentralized Finance (DeFi): USDT and USDC are widely used in various DeFi protocols. Users can lend their stablecoins to earn interest, provide liquidity to decentralized exchanges (DEXs), participate in yield farming, and collateralized loans. Stablecoins play a crucial role in facilitating the efficiency and functionality of DeFi applications.

- Cross-Platform Interoperability: USDT and USDC are compatible with multiple blockchain networks, allowing users to transfer funds seamlessly across different platforms. This interoperability enables individuals to leverage the advantages of various blockchain ecosystems while using a stable value for their transactions.

- Stable Value Storage: Investors and users who seek stability and a store of value in the crypto space often hold USDT or USDC to preserve the dollar equivalent of their assets. By converting volatile cryptocurrencies into stablecoins, they can mitigate the risks associated with market fluctuations.

USDT and USDC provide a reliable and convenient way of conducting transactions within the cryptocurrency ecosystem. The choice between the two often depends on individual preferences, availability on specific platforms, and transparency and regulatory compliance considerations.

As the use cases for stablecoins continue to expand, USDT and USDC are likely to play significant roles in shaping the future of digital payments, trading, and decentralized finance.

Conclusion

As we can see from the comparison, USDT and USDC have established themselves as prominent stablecoins in the cryptocurrency market, serving similar use cases and providing stability in a volatile industry.

USDT, being the more prominent and established stablecoin, has faced scrutiny but has maintained its position as the market leader. On the other hand, USDC has gained recognition for its transparency and resilience.

As the demand for stablecoins continues to grow, USDT and USDC will likely play important roles in facilitating trading, remittances, payments, and the expansion of decentralized finance. Ultimately, the choice between the two depends on individual preferences and specific requirements.

Frequently Asked Questions

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.