Do you want to use the Free Crypto Tax Calculator, the best crypto tax software for various countries including the United States, India, Canada, the United Kingdom, Australia, and more? This tool will help you.

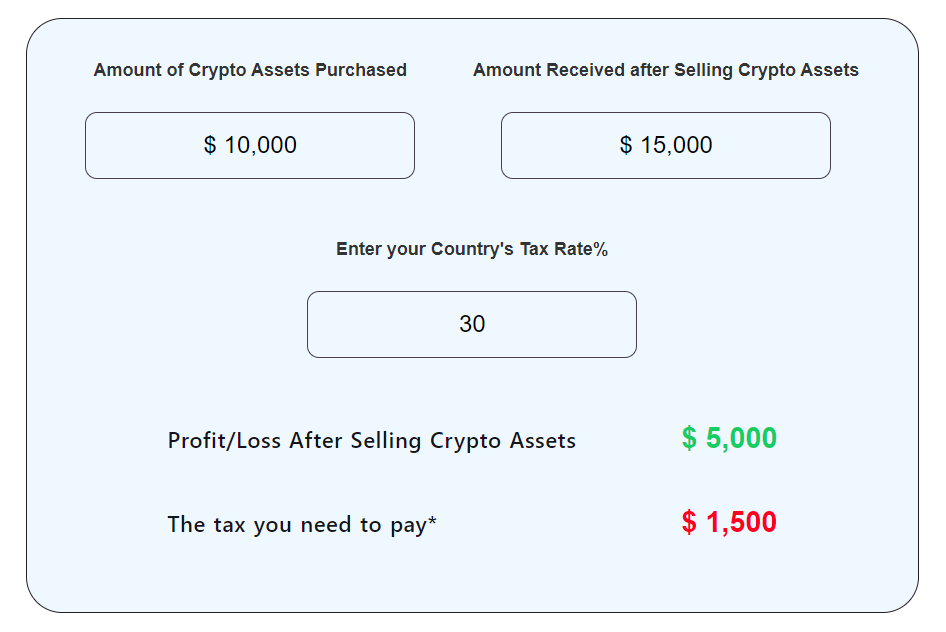

Profit/Loss After Selling Crypto Assets

The tax you need to pay*

How do I use this crypto tax calculator?

This is a very easy-to-use crypto tax calculator. You can get an estimate of your crypto tax in just a few steps

- Enter your Initial capital amount invested in crypto assets.

- Enter the amount after selling crypto assets.

- Enter the crypto Tax Rate according to your country.

Note – If you don’t know the crypto tax rate% of your country, then read this article below. You will be able to find the tax rate for your country.

How is Crypto Taxed in the United States?

The tax treatment of cryptocurrency in the United States depends on how it is used. Here are some examples of how cryptocurrency is taxed in the United States:

- If you buy and hold cryptocurrency as an investment: When you sell or exchange cryptocurrency, you may have to pay a capital gains tax on any profits or losses. If you hold the cryptocurrency for less than one year before selling or exchanging it, it is considered a short-term capital gain or loss and is taxed at the same rate as your ordinary income, which can range from 10% to 37% based on your income level. The tax rate is lower if you hold the crypto for longer than a year because it is seen as a long-term capital gain or loss.

- Receive cryptocurrency as payment: If you get paid in crypto, the value of the coin at the time you got it is treated as taxable income. On your tax return, you must disclose this income.

- Tax on cryptocurrency mining: Cryptocurrency mining generates tax revenue equal to the cryptocurrency’s real market value at the time it was mined. Your tax return needs to include a statement of this revenue.

You can use this crypto tax calculator to get an estimate of the tax you will owe on your cryptocurrency profits.

Accurate record-keeping of all cryptocurrency transactions is important because the Internal Revenue Service (IRS) may request this information for tax purposes. The IRS has published guidance on the tax treatment of cryptocurrency transactions on its website.

How is Crypto Taxed in India?

The Indian finance minister has released information on the taxation of cryptocurrency or digital assets in the 2022 Union Budget. This includes the following examples of how cryptocurrency is taxed in India:

- Buy Sell Crypto: In India, profits from cryptocurrency transactions are subject to a flat tax rate of 30%. In addition, there is a 1% Tax Deducted at Source (TDS) on every cryptocurrency transaction.

- Sell on loss: Indian investors cannot use losses from their cryptocurrency investments to reduce the amount of tax they owe on other forms of income. They can only claim the cost of purchasing the cryptocurrency as a deduction.

Use our crypto tax calculator to get an estimate of the tax you will owe on your cryptocurrency profits.

Must Read: 7 Crypto Jobs That Can Make You a Millionaire

How is Crypto Taxed in Canada?

- The Canadian Revenue Agency (CRA) views cryptocurrency as a commodity, rather than a currency, for tax purposes.

- This means that cryptocurrency transactions may be subject to either Capital Gains Tax or Income Tax.

- If an individual’s cryptocurrency is taxed as income, they will pay Income Tax on the entire proceeds of the transaction.

- If an individual’s cryptocurrency is taxed as a capital gain, they will only pay Capital Gains Tax on half of the profits from the transaction.

- The tax treatment of an individual’s cryptocurrency transactions depends on whether they are viewed as business income or capital gain by the CRA.

How is Crypto Taxed in the United Kingdom?

- In the UK, capital gains from cryptocurrency above the £12,300 (about $16,900) tax-free allowance are subject to a tax rate of 10% or 20%.

- Additional income from cryptocurrency above the personal allowance is subject to a tax rate of between 20% and 45%.

- The specific tax rate that applies to an individual’s cryptocurrency transactions depends on the nature of the transaction, the tax that applies, and the individual’s Income Tax band.

- The tax-free allowance and personal allowance are thresholds at which an individual begins to pay tax on their cryptocurrency gains and income, respectively.

How is Crypto Taxed in Australia?

- In Australia, capital gains from cryptocurrency investments are generally subject to Capital Gains Tax.

- Capital gains and losses from cryptocurrency are reported as part of an individual’s Income Tax Return and are subject to Income Tax.

- The percentage of Income Tax owed on cryptocurrency gains is the same as the individual’s personal Income Tax rate, starting at earnings above AUD 18,201 (about $13,500).

- If an individual holds their cryptocurrency for at least one year, they are entitled to a 50% discount on their capital gains for that particular asset.

- Individuals who have sold, traded, or earned cryptocurrency in the previous financial year must declare this to the Australian Taxation Office (ATO) in their annual tax return.

Do I have to pay taxes on crypto if I don’t cash out?

Yes, it is possible that you may have to pay taxes on your cryptocurrency even if you do not sell or cash out your holdings. The specific tax rules that apply to your cryptocurrency will depend on the laws in your country and the circumstances of your cryptocurrency transactions. It is important to understand these rules and consult with a tax professional. You can use this crypto tax calculator to get an estimate of the tax you will owe on your cryptocurrency profits.

Do I have to pay taxes on crypto if I reinvest?

Yes, it is possible that you may have to pay taxes on your cryptocurrency gains even if you reinvest them into additional cryptocurrency holdings. The specific tax rules that apply to your cryptocurrency transactions will depend on the laws in your country and the circumstances of your transactions. For example, if you sell cryptocurrency and realize a profit, you may be required to pay capital gains tax on the profit even if you reinvest the proceeds into additional cryptocurrency. You can use this crypto tax calculator to get an estimate of the tax you will owe on your cryptocurrency profits.

Do I have to pay taxes on cryptocurrency gains?

Yes, In the United States, you have to pay taxes on cryptocurrency gains. and you can use our free crypto tax calculator to get an estimate of the tax on crypto gains. This tax applies whether you are an individual or a business. If you made a profit by buying and selling cryptocurrency, you might have to pay taxes on your gains. The amount of tax you have to pay will depend on how long you held the cryptocurrency and what your taxable income is.

If you held the cryptocurrency for less than one year, you will be taxed at your ordinary income tax rate. If you held the cryptocurrency for more than one year, you will be taxed at the lower long-term capital gains tax rate. You will need to report your cryptocurrency gains or losses on your tax return and pay the appropriate taxes. You can use this crypto tax calculator to get an estimate of the tax you will owe on your cryptocurrency profits.

How to save capital gains tax on cryptocurrency?

Here are the Top 7 ways you can use them to save capital gains tax on cryptocurrency:

- Hold onto your cryptocurrency for more than a year before selling it. Long-term capital gains, which apply to assets held for more than a year, are generally taxed at a lower rate than short-term capital gains.

- Consider donating your cryptocurrency to a charitable organization. This can not only help you reduce your capital gains tax liability, but also allows you to make a positive impact through charitable giving.

- Use a retirement account to buy and hold cryptocurrency. Retirement accounts, such as a traditional IRA or a self-directed IRA, offer tax benefits that can help you save on capital gains tax.

- Invest in a cryptocurrency index fund. These funds invest in a basket of different cryptocurrencies, which can help you diversify your portfolio and potentially reduce your tax liability.

- Use a foreign exchange trading account to buy and sell cryptocurrency. In some cases, foreign exchange trades may be taxed at a lower rate than capital gains.

- Invest in cryptocurrency through a partnership or limited liability company (LLC). These business structures may offer tax advantages that can help you save on capital gains tax.

- Consider using a tax-advantaged account, such as a health savings account (HSA) or a flexible spending account (FSA), to buy and hold cryptocurrency.

We recommend always using our free crypto tax calculator to get an estimate of the tax on crypto gains. And keep in mind that the tax treatment of cryptocurrency may vary depending on your country of residence, and it is always a good idea to consult with a tax professional for guidance on your specific situation.

Must Read: How to Do Fundamental Analysis on Crypto Projects

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.