Although relatively young, the crypto world is becoming more complex, with new strategies and technological advancements introduced daily. Therefore, keeping up with all the cryptography, blockchain, and investing terminology may be complicated, especially if you are just starting your crypto journey.

APR and APY are terms often associated with the financial industry as a measurement of interest. With the advancement of digital assets, APR and APY have found their way into crypto to calculate the annual interest of an investment, loan, or staking mechanism.

This article will guide you through the meaning of APR and APY in crypto, the differences between the two methods, and how to calculate them with the help of practical examples. Let’s get started and bring your crypto knowledge to the next level.

What do APR and APY Mean?

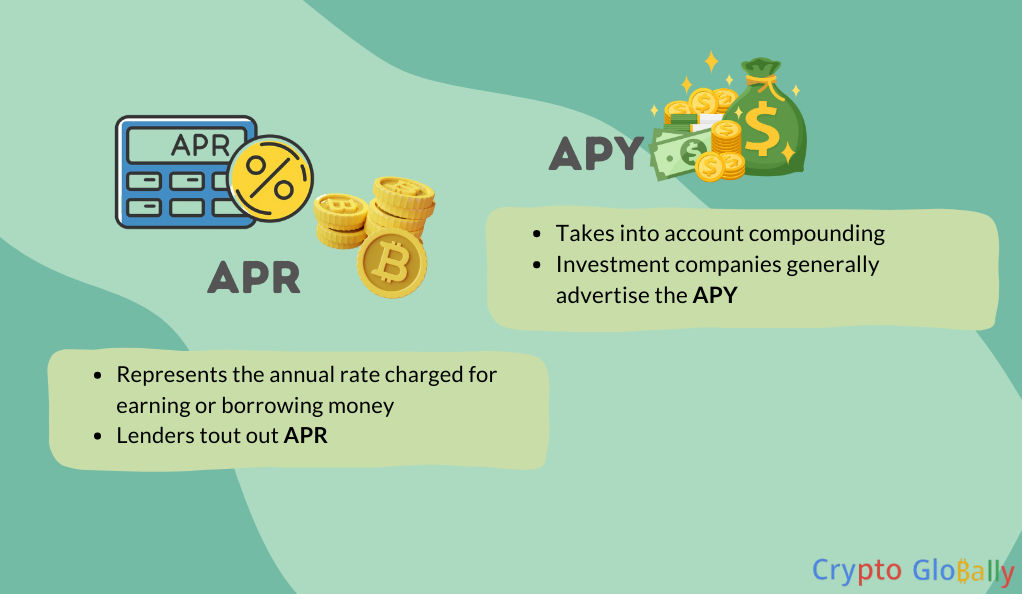

Before we dive into the crypto world, let’s first get a general understanding of what these two popular abbreviations mean. APR stands for Annual Percentage Rate and is used as a calculation method for finding the cost of borrowing or ROI using simple interest. As annual in its title suggests, it measures the rate in one year and does not take compounding into account.

On the other hand, APY, which stands for Annual Percentage Yield, is similar to APR as it is also used to measure the annual interest rate. However, the main difference between the two metrics is the fact that APY uses compounding interest to estimate the amount of money earned over a year.

How are APR and APY Related to the Crypto World?

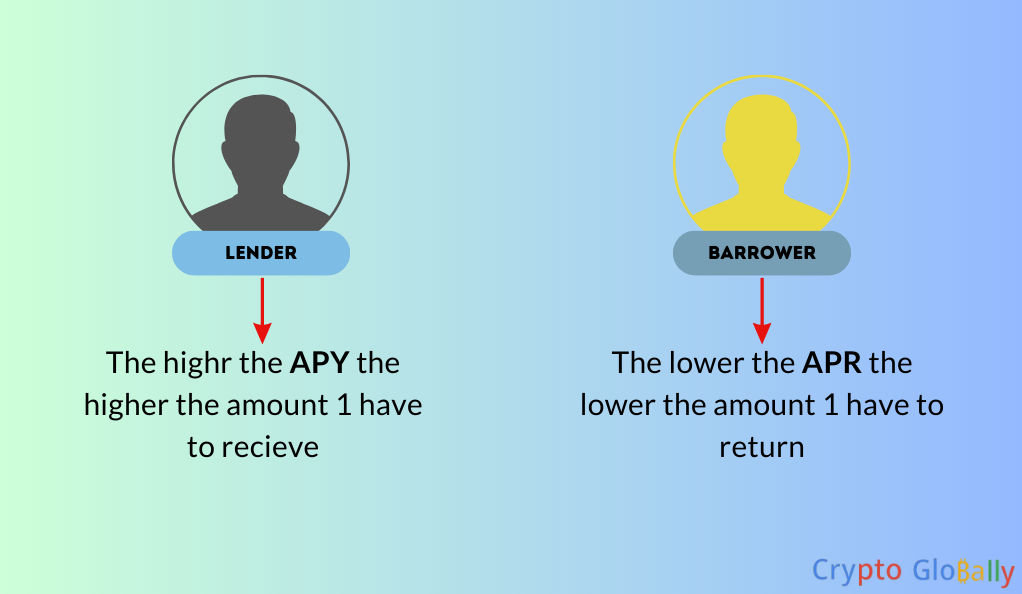

A few differences exist in using the financial terms APR and APY in the crypto niche, but the overall meaning remains the same. In the traditional finance sector, APR is more applicable for borrowing money; therefore, it is widely used to calculate the cost of mortgages, credit cards, and other forms of credit. In the crypto world, investors and traders commonly use APY to estimate the costs associated with crypto lending and borrowing and to compare different crypto loans.

In contrast, APY is more appropriate for lenders, meaning that the metric is typically used for measuring compound interest for savings accounts, bonds, mutual funds, and more. When it comes to cryptocurrencies, APY can be utilized for yield farming, staking, and in some DeFi investment strategies.

APR in Crypto Explained

APR, or annual percentage rate, is the reward that investors may gain by making their crypto tokens available for lending, taking into account interest rates and any other costs investors must pay. APR, often called simple interest, provides DeFi users with a figure that can be readily compared to different protocol rates. Many crypto exchanges give investors the freedom to lend their cryptocurrencies and earn APR, but rates and charges differ from each other, depending on the loan or currency you lend.

How to Calculate the APR of Your Cryptocurrencies?

Below you can find the basic formula used to calculate the APR of a crypto investment:

APR = [P × (1 + R × T)]

Where:

P (Principal) – represents the initial amount of money invested or borrowed

R (Interest) – refers to the total interest earned or paid during the specified period

T (Time) – indicates the time the interest is calculated (usually in years)

To gain a better understanding of the formula, let’s use a simulated example:

To gain a better understanding of the formula, let’s use a simulated example:

Suppose you decide to lend 1 ETH on a DeFi platform that offers a 10% annual interest rate (APR). You deposit your 1 ETH and start earning interest immediately. After one year, you would have made 0.1 ETH as interest.

Looking at the equation from a price perspective, let’s consider the current price of Ethereum, which stands at 1,896.46, and round it at $1,900 for simplicity. Your initial investment of 1 ETH would be worth $1,900. Additionally, the 0.1 ETH earned as interest would be worth $190. Therefore, your total investment value after one year would be $2,090.

APY in Crypto Explained

APY stands for annual percentage yield and estimates the amount of money generated over a year in lending and yield farming protocols. Some factors to consider concerning compounding returns include the fees, token prices, interest-earning procedures, and the sorts of crypto assets offered.

Simple interest is earned when the APY is the same as the interest rate on a person’s investment. The investment is compounding when the APY is larger than the interest rate. This suggests that the investor is essentially receiving interest on his accumulated interest.

Regarding crypto, APY is computed variably, depending on how frequently the yield is paid. For example, some tokens allow investors to earn rewards paid in crypto every couple of hours a day. This means that the deposited tokens will compound several times within a day, resulting in higher APY.

How to Calculate the APY of Your Cryptocurrencies?

The standard way of calculating APY is with the following formula:

APY = (1 + r/n)n – 1

Where:

r – stated annual interest rate

n – number of compounding periods each year

Now, let’s explain the calculation; we will use the scenario outlined with the APR formula. We again deposit 1 ETH, with an APY of 10%.

We will assume that the compounding is done monthly. To calculate the APY monthly interest rate, we divide the APY by 12. In this case, the monthly interest rate would be approximately 0.83% (10% / 12 = 0.83%).

After one year of compounding interest, you would have earned approximately 0.0105 ETH as interest. This calculation considers the compounding effect of making interest on the previous interest earned.

Considering the current price of Ethereum at $1,900, your initial investment of 1 ETH would still be worth $1,900. The 0.0105 ETH earned as interest would be worth approximately $19.95. Ultimately, your total investment value after one year would be roughly $1,919.95.

APR vs APY for Crypto: Key Differences

APR and APY are seemingly identical, as they are two metrics used to measure p.a. interest rate. Although compound interest differentiates APY from APR, you must consider other factors, methodologies, and use cases to understand the formulas better. The table below outlines the key differences between APR and APY in crypto:

| Annual Percentage Rate (APR) | Annual Percentage Yield (APY) | |

| Compounding Effects | Doesn’t take into account compounding when calculating interest | Takes into account compound interest as the basis of the calculation |

| Use Cases | Mainly used for borrowing; Measures costs associated with crypto lending and borrowing and as comparison for different crypto loans | Mainly used for lending; Yield farming, staking, DeFi investment strategies, etc. |

| Calculation Method | APR is calculated by taking the simple interest rate and multiplying it by the number of compounding periods in a year, expressed as a percentage | APY considers the effect of compounding by adding 1 to the periodic interest rate, raising it to the power of the number of compounding periods, subtracting 1, and expressing the result as a percentage |

Why Should you Calculate the APR or APY of your Crypto Portfolio?

Calculating APR and APY in crypto may seem like a tedious activity that serves the sole purpose of calculating interest. However, you may be surprised how valuable using APR or APY in your crypto activities can be. Here is a list of some of the benefits you will get from calculating the APR and APY of your cryptos:

- You will get a better evaluation of the return on investment (ROI) of your crypto deals. These techniques will give you a better overview of your current portfolio and turn it into investment ideas for the future.

- Gain more precise insights into the borrowing costs you must pay when taking out a crypto loan. You will learn how to distinguish the most cost-effective deals throughout the process.

- APR and APY can also serve as practical metrics for assessing the overall performance of your crypto portfolio. You can find out which strategies work and when it is time to ditch the ones that are a liability.

- Your crypto investment skill will improve as you become more knowledgeable about executing calculations related to different crypto trading activities. Therefore, the practice will help you make more informed trading decisions.

Additional Factors to Consider When Calculating APR and APY of Cryptos

APR and APY are precise measures to calculate the interest you will earn from your crypto investments, staked coins, or the costs associated with your crypto loans. However, below, we have listed several other factors you need to consider if you want to keep perfect track of your crypto finances:

Interest Compounding

Interest compounding is a long-term investment strategy crypto investors use to generate passive income. It is reinvesting the interest earned and gaining more revenue from the process. Exchanges offer different interest-compounding intervals, so pick the one best suited for your strategy.

Transaction Fees and Charges

To precisely calculate your costs or returns, you must include all fees the platforms charge. This is to say, the transaction fees, exchange fees, transfer fees, gas fees, and any other associated costs.

Volatility of the Cryptocurrency Market

Digital assets like cryptocurrencies are volatile in nature, meaning that your initial investment’s value may change over time. And it sure may change drastically, as we have witnessed the crypto winter’s impact on the market. Calculating APR and APY in volatile market conditions is challenging, so consider this when making a financial decision.

Other Staking or Lending Rewards

Finally, crypto brokerages offer incentives and rewards to users who stake, lend, borrow, or lock a certain amount of crypto for a specified period. One such program is Crypto.com’s Crypto Earn, which pays p.a. interest. Remember to track your rewards for a better overview of your financials.

Final Thoughts

Understanding concepts like APR and APY becomes increasingly essential for investors and traders as the crypto world evolves and matures. These metrics provide valuable insights into the costs, returns, and performance of crypto investments, loans, and staking mechanisms.

By calculating APR and APY, you can better understand your crypto portfolio’s ROI, evaluate the borrowing costs associated with crypto loans, and assess the overall performance of your investment strategies. These calculations empower you to make more informed decisions and optimize crypto activities, making you a more skilled crypto investor.

Frequently Asked Questions

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.