The crypto world is ever-evolving, and investors get introduced to new technologies, regulations, and changes daily. The dynamic landscape gives market participants even more opportunities for profit gains, and properly keeping track of your crypto portfolio is an essential instrument for success. Calculating the profits and losses (PnL) of your crypto trades gives valuable insights into the performance of your investments and how you are progressing toward your financial goals

Furthermore, managing your crypto portfolio using practical profit and loss calculation strategies will help you improve your skills as an investor. With better risk management and an accurate overview of your trades’ performance, you will boost your crypto trading efforts to the next level.

In this article, traders will learn what profit and loss calculation means in the crypto world and the four most popular strategies traders use. Learn through simulated trading examples, valuable practices, and tools by going through our crypto profits and loss calculation guide!

Key Points:

- A crypto portfolio’s profit and loss calculation is essential for evaluating a trader’s performance on the market

- To improve their investment skills, traders can pick and adapt different PnL strategies to their trading style

- Learn the four most popular profit and loss calculation strategies and how to implement them

Understanding Profits and Losses (PnL)

If you have made crypto investments, you have already realized that some have made you money, while on other trades you may have lost money. Calculating your profits and losses on deals is the process of assessing the performance of these assets over a specified period.

With the help of an effective PnL calculation strategy, you get insights into how your positions in the crypto market are serving your portfolio. As a result, you will also learn how much money you lose and gain on each trade.

Figuring out the gains and losses of your crypto assets creates a more streamlined investment process that uses data from your own trades. Furthermore, it will give you other benefits that will contribute to making more informed investment decisions.

Why is it Important to Calculate the Profit and Loss of Your Crypto Portfolio?

Now that we understand PnL calculation better, let’s examine the importance of incorporating this priceless technique into your trading strategy.

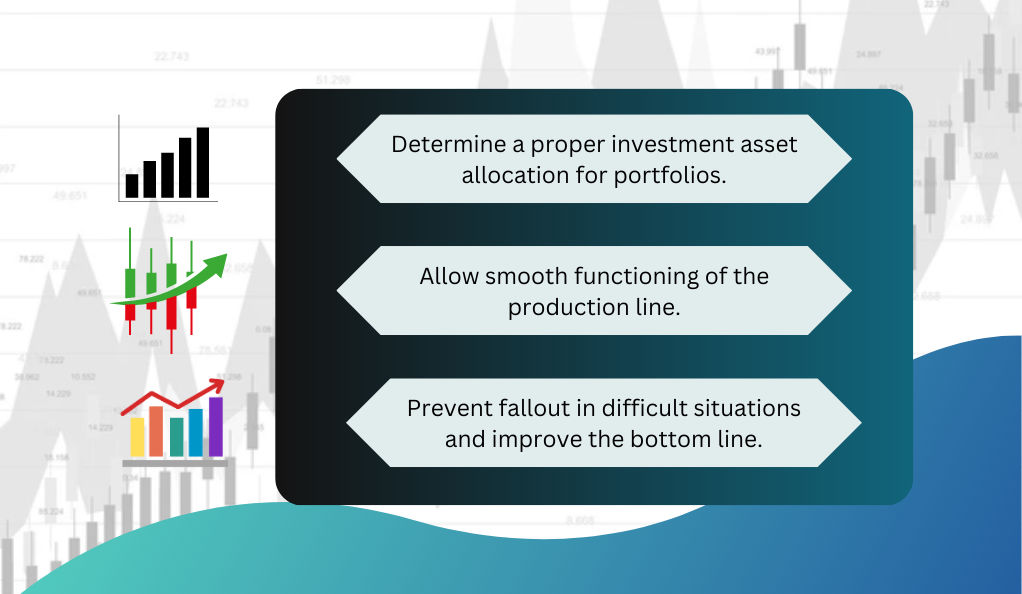

First and foremost, you will gain insights into how your money works for or against you in your portfolio of cryptocurrencies. Logging into your online broker and finding out that the meme coin you predicted to skyrocket has lost 90% of your initial investment isn’t pleasing. But it sure gives you insights you can use to determine which assets you should keep, sell or buy more of.

Tracking how much you profit and lose from your crypto positions has a range of other benefits. Better risk management, strategy optimization, and potential for higher returns are some key advantages you may utilise.

To reap all the benefits of crypto profit and loss portfolio management, you must first understand the process behind the numbers and calculations.

How to Calculate the Profit and Loss of Your Crypto Portfolio?

Don’t let maths scare you; making profits and loss calculations is more straightforward than it may seem. In fact, you need to keep track of two simple metrics: the initial price for which you bought the crypto asset and its current market value. The four strategies we have outlined below are crypto investors’ most functional methods to calculate gains and losses:

Strategy 1: Crypto Portfolio Positions

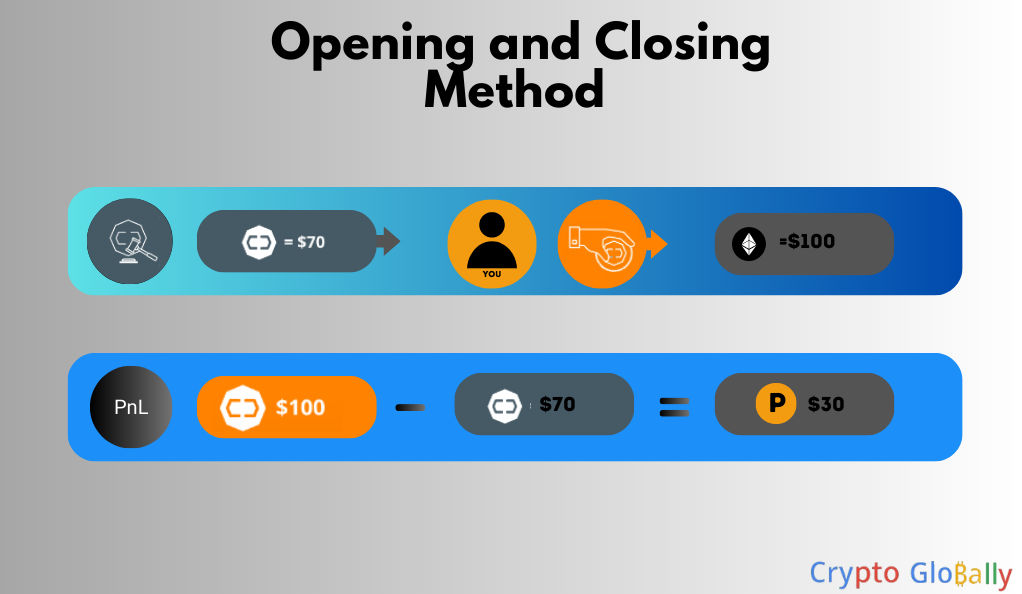

To calculate the profits and losses of your crypto investments, you can use the status of your positions. There are two types of crypto trading positions: an open position and a closed position.

An open position refers to the initial investment you have made into a specific crypto coin, for example, Ethereum. When you sell that same Ethereum, the position becomes closed.

To make the most out of this strategy, you can classify the positions into two groups: open and closed. With the first group, you can track the initial price of your investment and its current market value. With the second group, you can separate the closed positions on which you profited from the ones you lost money.

You can also use different factors for better clarity, visibility, and more detailed data. For example, separating long-term investments from short-term investments will best distinguish your buy-and-hold strategy from your day trading efforts.

Strategy 2: Transaction-by-Transaction

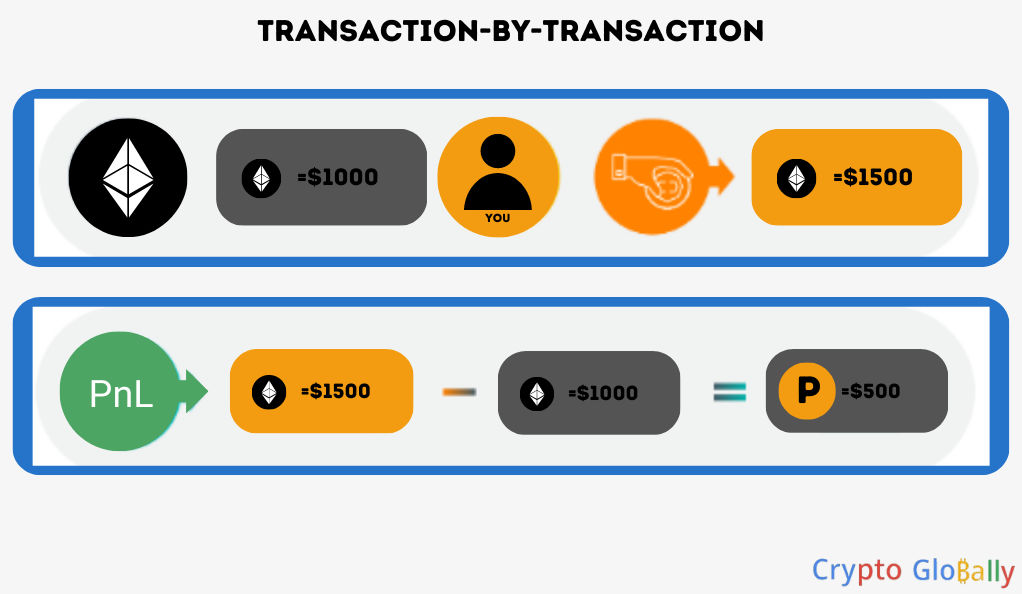

The transaction-by-transaction calculation strategy is designed for traders who engage in daily crypto trading activities. This approach takes into account the results of each specific transaction. If you are an active crypto trader making multiple deals daily, this approach will be the most applicable for calculating your profits and losses.

For example, if you have opened and closed three positions on ETH on the same day, you can track how much you have made or lost. To do that, you can use the transaction-by-transaction formula.

Here is the equation you need to use for calculating your PnL based on your transactions:

S (Selling Price) – C (Cost) = P (Profit)

To break down this equation, take the price you sold your crypto asset (selling price), and extract the initial price you bought the coin (cost). Remember to include all taxes and fees you paid for the transaction. As a result, you will get your final PnL score (profit).

Strategy 3: Evaluating Year-to-Date (YTD) PnL

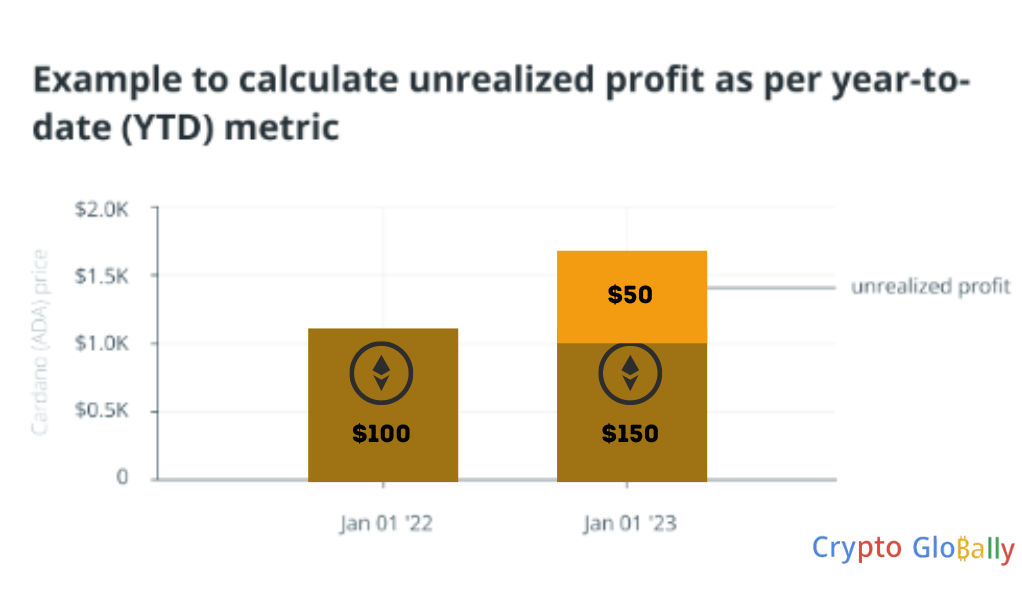

The year-to-date (YTD) strategy is most popular among traders who have adopted a long-term investment strategy. These investors open a crypto position and hold it with the premise that the asset’s value will appreciate in the future.

This method takes the price at which you bought a cryptocurrency at the beginning of the year and compares it to the current date price or at the end of the year. You may also modify the period or track a specific coin, a group of assets, or your whole portfolio.

To use a practical example, let’s say you have bought $100 worth of ETH at the beginning of the year. At the year-end, the value of your ETH investment may have increased to $150, resulting in an unrealized profit of $50.

Unrealized profit is the earnings you accumulate before converting your ETH into cash or equivalent, like stablecoins.

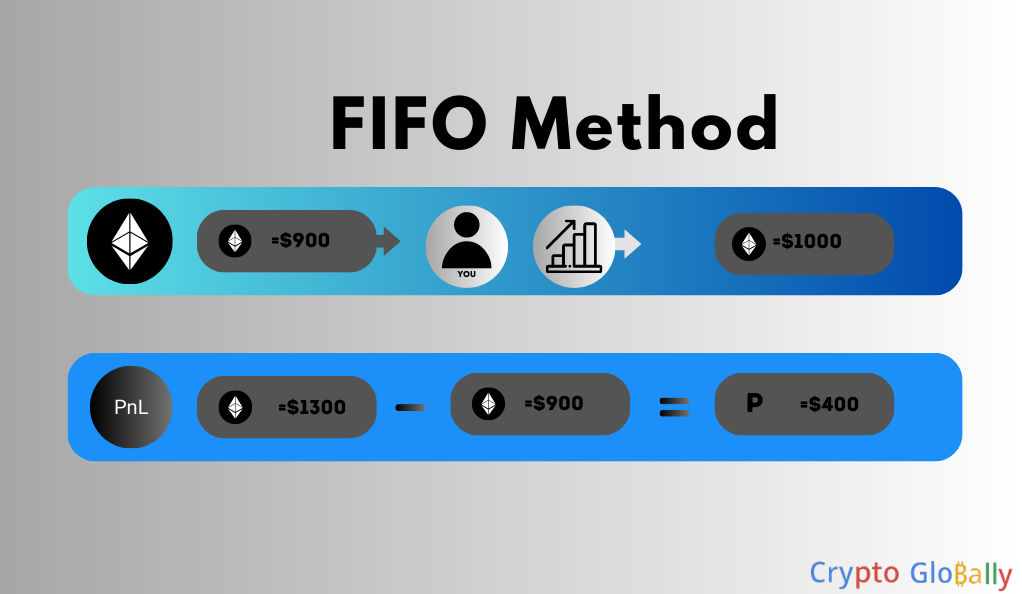

Strategy 4: First-in, first-out (FIFO) Cost Basis Method

The first-in, first-out (FIFO) strategy is a widely used calculation method by traders but also by accountants for tax purposes. This method takes a chronological approach to calculating the PnL of a crypto portfolio.

Three elements form the FIFO strategy:

- The crypto asset’s initial buying price (The formula’s cost basis)

- The current market value of the asset

- The capital gain (Realized profit)

Suppose you’ve bought Ethereum worth $1000 but saw another opportunity to buy at $900. Using FIFO, you will use the first chronological price when you decide to sell your Ethereum, which is now worth $1300. To calculate your PnL, deduct the current market value from the cost basis to get your capital gain result.

The FIFO strategy can be beneficial in volatile crypto markets when investors are stressed about the performance of their investment portfolio. This method allows traders to form a realistic perspective for their crypto profits and losses.

Other Practical Profit and Loss Calculation Strategies to Consider

We present four additional approaches for investors looking to go the extra mile and expand their arsenal of crypto PnL strategies. Different factors may influence your choice, so understanding the various calculation techniques will help you find the one that fits your needs the best:

Last-in, first-out (LIFO) Strategy

LIFO shares many similarities with the FIFO strategy, yet, with two considerable differences. Instead of the initial buying price of the crypto asset, LIFO uses the latest buying price. In simpler terms, the last coin you buy becomes the first coin you sell. The best fit for this strategy would be during bullish market conditions.

Highest-in, first-out (HIFO) Strategy

The HIFO strategy prioritizes selling the most recently purchased coin with the highest price. Compared to FIFO and LIFO, the highest-in, first-out method is the most efficient for tax optimization. If you want to minimize your tax liabilities, especially in jurisdictions where capital gains are taxed, HIFO will be your most beneficial choice.

Weighted Average Cost (WAC) Strategy

The WAC strategy is another streamlined and simplified approach for traders involved in regular trading activities. This strategy uses the total value of your crypto portfolio to determine the average cost per coin. You then subtract the current price of the crypto to get your PnL. As it provides a single cost basis for your entire portfolio, WAC also makes tracking your long-term profitability easier.

Ideal Selling Price using the Percentage Profit Strategy

Seasoned traders often use this strategy to determine the target profit percentage of their crypto deals. For instance, you can utilise the percentage profit method if you plan to sell a particular asset at 10% profit. To do so, multiply the initial buying price by 1.1, and monitor your investment.

How to Choose the Best PnL Calculation Strategy?

We’ve already outlined eight PnL calculation strategies, so you may wonder which one is the best. Although it may not come as a surprise, this question has no correct answer, as each model is unique and proposes different benefits. Therefore, your choice should rather be influenced based on several factors:

Firstly, arm yourself with the fundamental knowledge of the methodologies, formulas, and implications for market conditions for each calculation. Familiarizing with the techniques will help you make an informed decision and gain the necessary skills to employ the strategies.

After you have the facts nailed in, it is time to evaluate your personal trading style, strategies, and goals. Find out whether you are an active day trader or prefer to invest in the long term. Do you make high-risk investments or like to stick to safer investment options? Understanding where you stand as a cryptocurrency trader and what you aim to achieve with your portfolio makes for a much more straightforward choice.

Lastly, consider what approach you are going to employ. Will you monitor and imply strategies on your own, or will you seek the assistance of professional advisors or tools? You will get more clarity in the next section if you are still deciding which direction to pick.

Useful Gains and Loss Calculation Tools

Using the old-fashioned way and manually calculating the PnL of your crypto portfolio could be a hassle. This is especially valid when considering the volatile nature of the market and the vast number of deals executed daily. Fortunately, investors can use several useful tools which make calculating profits and losses an automated and precise process:

- Platforms like TradingView, which offer real-time crypto prices, data, and a variety of technical analysis tools

- Profit and loss calculators help investors utilise the most valuable PnL crypto calculation strategies and identify net/gross gains or losses generated

- Opting for a brokerage account takes the weight off your shoulders, as the platforms offer full-blown services which automatically calculate your crypto portfolio’s PnL

Once again, it comes to your personal trading style, strategy, and goals to determine which tool to use. It is vital, however, to pick at least one for better portfolio tracking and accurate performance assessment.

Final Thoughts

Adopting a profits and loss calculation strategy is fundamental to enhancing your crypto trading skills and improving your investment portfolio. You will get better insights into how your crypto trades perform by picking a PnL calculation method from the ones we mentioned above. Remember, there is no right or wrong pick; choosing the right approach should fit your investment style, strategy, and goals. With accurate tracking and analysis, you can confidently navigate the dynamic crypto market and work towards achieving your financial goals.

Frequently Asked Questions

CryptoGlobally aims to offer impartial and trustworthy data on cryptocurrency, finance, trading, and shares. Yet, we can't give financial guidance and encourage individuals to conduct their own studies and thorough checks.